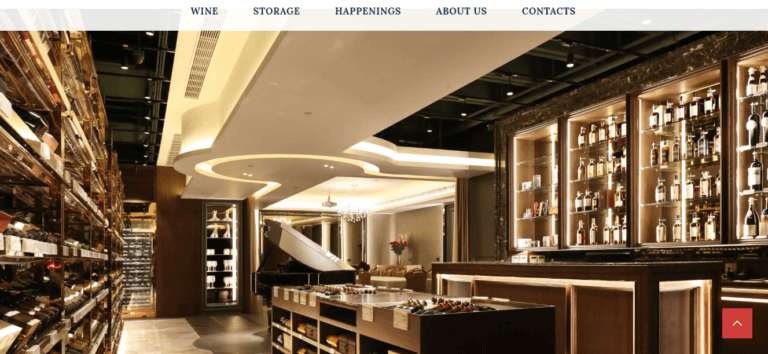

Madison Group Holdings Limited, a Hong Kong-based investment holding company “engaged in the retail and wholesale of various wine products”, is reportedly planning to acquire a stake in BitOcean, a Japanese cryptoasset exchange.

$30+ Million Ownership Share

According to the South China Morning Post (SCMP), the Madison Group noted in a filing to the Stock Exchange of Hong Kong (SEHK) that it was planning to acquire a 67.2% share in BitOcean through its subsidiary, Madison Lab. The acquisition is reportedly worth 1.68 billion Japanese yen (appr. $15.12 million), in addition to other business-related fees of about $15 million.

Notably, BitOcean is one of only 16 digital currency exchanges in Japan that have been granted a license to offer crypto trading services by the Financial Services Agency (FSA), the country’s primary financial regulator. However, BitOcean has not officially started providing digital asset trading services yet.

According to quoted sources in Hong Kong, HDR Cadenza Management, a subsidiary of Seychelles-registered HDR Global Trading, the company that owns giant crypto derivatives trading platform BitMEX, might acquire a 51% stake (appr. $17.14 million) through a joint venture with Madison Labs. At present, this deal has not been finalized and the deal involving BitOcean is being reviewed.

Diversifying The Company’s Business

Commenting on the BitOcean deal, Raymond Ting Pang-wan, the chairman at Madison Group Holdings, said acquiring a stake in the cryptoasset exchange was part of the holding firm’s strategy to diversify its business. Pang-wan also noted that a partnership with BitMEX was important because the Madison Group was looking for help in developing its digital currency trading platform.

During an interview, Pan-wan remarked:

Our wine business is stable and profitable, but then it is small. It is hard to make wine trading into a very big business. This is why we have to diversify into financial technology and the cryptocurrency business – to achieve a better return for our shareholders.

He added that cryptocurrencies and their underlying blockchain technology are becoming “more popular”, and that investing in the crypto industry could potentially increase the company’s revenue. Despite the extended digital currency bear market, which has seen the market capitalization of all cryptocurrencies drop from over $800 billion (in December 2017) to currently around $127 billion, Pan-wan thinks it’s a good time to enter the blockchain sector.

“Bitcoin Is Cheap” Right Now

Pan-wan explained his company’s business strategy:

Bitcoin is cheap, which has created a good opportunity for us to enter the market. We are eyeing the long term, so we are not worried about short-term volatility.

Elaborating on why the Madison Group chose to acquire a stake in the BitOcean exchange, Pan-wan said digital currency trading had become quite popular in Japan and the country is also among the world’s leaders when it comes to developing a comprehensive regulatory framework for cryptoassets.

Pan-wan remarked:

Japan represents about 20% of bitcoin trading worldwide. Japan and the US are the only two markets that have a licensing system for such trading platforms. We wanted to invest in a platform that was under proper regulation.