EOSUSD Price Medium-term Trend: Bullish

Supply zones: $9.00, $10.00, $11.00

Demand zones: $2.00, $1.00, $0.50

EOS resumes bullish trend in its medium-term outlook. The bullish marubozu candle followed by the bullish engulfing candle on 28th December confirmed the bulls are now in charge of the market. EOSUSD rose to $2.88 in the supply area over the weekend as momentum gradually reduces on 29th December with the formation of a long-tailed inverted candle.

Correction to the move resulted in the bears dropping the price to $2.58 in the demand area.

Today’s opening 4-hour candle formed a bearish railroad and price was down to $2.53 in the demand area as the bearish momentum shows exhaustion and possible bull return.

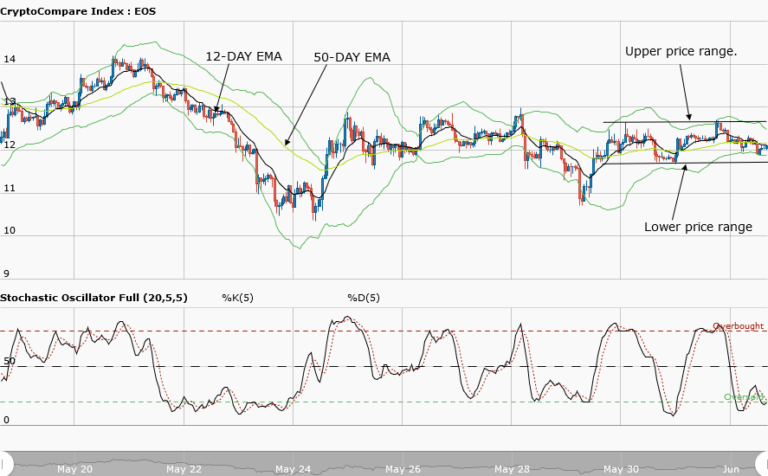

The price is below the two EMAs crossover while the stochastic oscillator signal points down at 22% which reflect the downward price movement before a possible reversal to the upside.

EOSUSD Price Short-term Trend: Ranging

EOS is in a range bound-market in its short-term outlook. After a bullish opening at $2.73 and minor push of the price to $2.77 in the supply area, the bears gradually staged a return which was confirmed by a bearish engulfing candle at $2.74 which dropped EOSUSD to $2.65 in the demand area.

The price is below the two EMAs and the stochastic oscillator signal points up at 38% as the cryptocurrency ranges.

EOS is in consolidation and trading between $2.78 in the upper supply area and at $2.53 in the lower demand area of the range. A breakout at the upper supply area or breakdown at the lower area may occur hence patience is required to allow this to happen before a position is taken.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research