Revolut, a UK-based financial firm that allows users to buy, sell, and store cryptocurrencies such as bitcoin (BTC), XRP, and ether (ETH), has announced that it has received a banking license from the European Central Bank. Established in 2015, Revolut has managed to raise $336 million in order to develop its suite of financial products.

The new banking license will allow Revolut to provide a broader range of regulated financial services to its clients. According to Revolut’s management team, there is some “behind the scenes” work that needs to be done, before the company can start offering full current accounts, overdraft protection, and various other traditional financial services.

Deposit Up To €100,000 Will Be Protected

The company’s founders, Nikolay Storonsky and Vlad Yatsenko, were able to recognize the potential of digital assets while also realizing that the space needs a regulated environment to help ensure consumer protection. Explaining the new privileges its customers would have now that the firm has a banking license, Revolut’s official blog post noted:

If you choose to open a full current account with Revolut Bank in the future, any funds you deposit will be protected up to €100,000 under the European Deposit Insurance Scheme (EDIS).

Other services that Revolut will be offering under the new license include convenient access to overdraft facilities for its clients, which means users don’t have to be concerned about receiving ‘insufficient funds’ notifications, negative account balances, and automatic top-ups.

Revolut’s announcement also mentioned that it would allow its customers to take out personal loans at competitive rates. Starting next year, the firm’s management team said they would do a few pilot programs (involving services supported by the license) with customers in Lithuania. At some later point, Revolut may expand its services to other locations across Europe.

18-Month Roadmap

In addition to providing loans and overdraft services, the new license will allow Revolut to offer UK direct debit payments. Moreover, the company is presently working on developing an in-house payment processor. The UK-based firm has also prepared an 18-month roadmap, which aims to implement the comprehensive range of financial services that it can now offer under the new banking license.

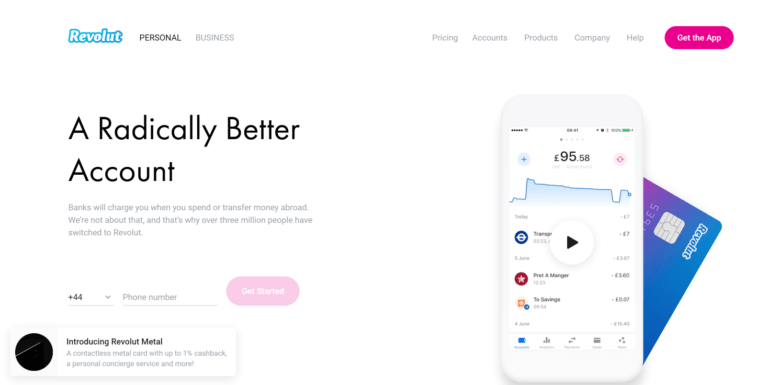

Revolut’s long-term plans include offering its new services to users based in the US. In late April, the fintech startup announced that it would begin listing bitcoin cash (BCH) and XRP on its trading platform. At the time, Revolut also revealed its plans to launch a metal Platinum debit card that would offer 1% cashback in digital currency.