On Tuesday (4 December 2018), CryptoCompare, a leading cryptocurrency market data provider, announced that “in response to customer demand for commercially scalable and customisable cryptocurrency data solutions,” it had added a powerful new commercial API service to complement its existing free API service.

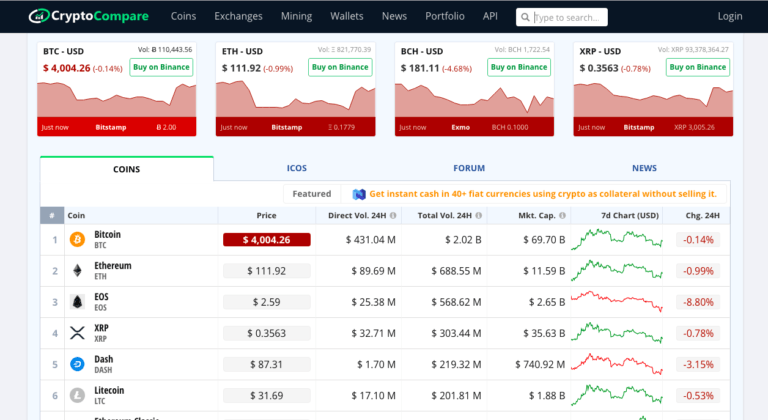

CryptoCompare, which was founded in 2014 and is headquartered in London, currently provides retail and institutional investors with reliable real-time cryptocurrency market data on 5,696 coins and 264,465 trading pairs.

What it most seems to pride itself on are the integrity and scope of the data it delivers. One way it tries to insure the integrity of its data is by reviewing crypto exchanges on a monthly basis, monitoring for market abuse, and taking regional anomalies and geographical movements into consideration. This monthly exchange review is considered essential reading by some of the biggest names in the crypto space. A few examples of major financial data providers that rely on CryptoCompare are Yahoo Finance, Thomson Reuters, and VanEck’s indices division MVIS.

On 6 November 2017, VanEck’s MVIS announced that it had “became the first major index provider to offer digital asset (crypto) indices” via a partnership with CryptoCompare, and said that “MVIS CryptoCompare Indices are the first to meet investment industry benchmarking standards by providing a public rulebook for fork treatments and other events, industry-wide data distribution, proper identifiers and further standard index governance requirements that are expected from a regulated, unaffiliated, major benchmark provider.”

Up until today, CryptoCompare was offering a very popular free “Personal” API service for providing access to crypto market data. This is perfect for “individual users who want to explore the capabilities of the API for research and personal projects, as well as sandbox testing for commercial users.” Those on this plan can use CryptoCompare’s data “under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License” (meaning that they must credit CryptoCompare with a link if they use its data in a mobile app or on a website). This plan allows:

- up to 100,000 API calls per month

- 20+ market data endpoints

- full historial data on all coins and exchanges

Now, with the addition of its new “Commercial” API service, which is available in three tiers, CryptoCompare seems to have come up with the “ultimate” API solution.

As you can see from the table below, there are three Commercial plans:

This new commercial API service is “tailored to the cryptocurrency data needs of the institutional and retail investors as well as third parties, partners and developers,” and offers “more flexibility such as extended historical data; customisable API endpoint solutions and call limits; dedicated support and service level agreements; and the ability to save/cache data locally for internal business purposes.”

It is important to note that all three of the above plans “include commercial redistribution rights, enabling third parties greater flexibility in using CryptoCompare’s data for their crypto investment products or market data needs.”

Charles Hayter, Co-Founder and CEO of CryptoCompare, had this to say about this new service:

“We continually invest in our technology and APIs to ensure our infrastructure remains robust and both the retail and institutional investor can access data as needed to execute trades on their investment portfolios. We adhere to rigorous standards to safeguard data integrity, normalising global data sources to ensure consistency and confidence in the market.

We’re very excited to launch this extended API service to the crypto community, providing commercial licenses for third parties, partners and investors alike. We developed this new offering in response to demands from both individuals and institutions for more complex, often bespoke yet highly scalable cryptocurrency data solutions.”

All Images Courtesy of CryptoCompare