On Friday (7 December 2017), Gemini Trust Company, the digital asset exchange and custodian founded by Cameron and Tyler Winklevoss in 2014, announced that it has added support for trading and custody of the ABC variant of Bitcoin Cash (BCH).

Bitcoin Cash, which came into existence as a fork of Bitcoin (BTC) on 1 August 2017, was split into two variants—Bitcoin ABC (supported By Bitmain and Bitcoin.com) and Bitcoin SV (supported by Dr. Craig Wright and Calvin Ayre)—as the result of a highly controversial hard fork on 15 November 2018.

All crypto exchanges that supported Bitcoin Cash before November 15th are supporting the ABC variant, most (e.g. Binance, Poloniex, Bittrex, Kraken, and OKEx) are supporting both the ABC variant and the SV variant, and a few (e.g. Coinbase, Bitstamp) have decided not to support the SV variant. Unfortunately, there is one more source of confusion: The tickers for ABC and SV vary across wallets and exchanges. The ABC variant is represented by BCHABC, BAB, or BCH; and the SV variant is represented by BCHSV or BSV.

In Friday’s blog post, Eric Winer, Gemini’s Vice President of Engineering, said that, for the time being, Gemini will only be supporting the ABC variant, will be referring to this as “Bitcoin Cash”, and given it the “BCH” ticker. He also explained that Gemini has “added replay protection to all BCH withdrawals from the Gemini platform to ensure transactions are only valid on the Bitcoin ABC blockchain.” As for the SV variant, he stated that Gemini will be “continuing to evaluate Bitcoin SV over the coming weeks or months, and we may or may not choose to support withdrawals and/or trading of Bitcoin SV in the future.”

BCH deposits will be accepted starting at 09:30 ET (14:30 UTC) on Saturday, December 8th, with trading set to begin on Monday, December 10th, at 13:00 ET (18:00 UTC).

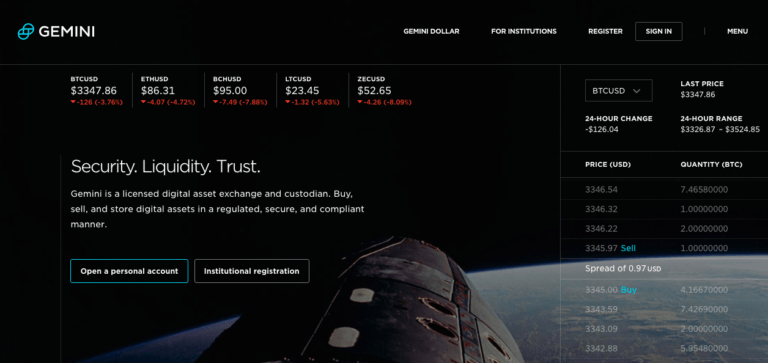

This means that Gemini now supports five digital assets: Bitcoin (ABC); Bitcoin Cash (BCH); Ether (ETH); Litecoin (LTC); and Zcash (ZEC).

Gemini will be offering the following trading pairs for Bitcoin Cash: BCH-USD; BCH-BTC; BCH-ETH; LTC-BCH; and ZEC-BCH.

Gemini also wants you to know that it has “worked closely with the New York State Department of Financial Services (NYSDFS) to obtain approval to offer Bitcoin Cash trading and custody services.”

Featured Image Courtesy of Gemini Trust Company