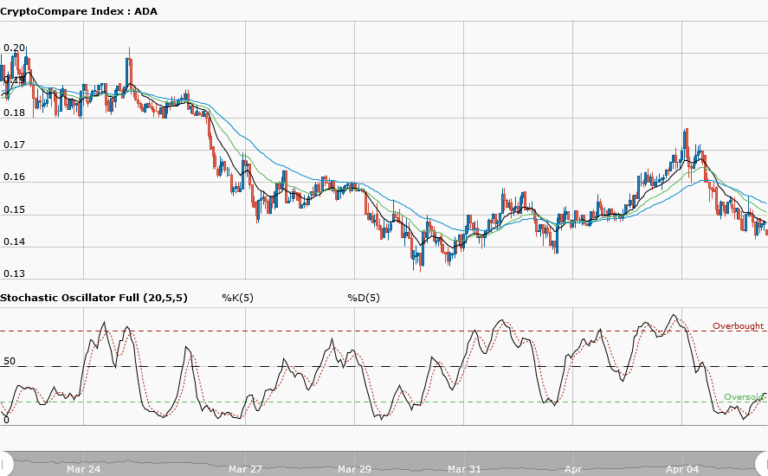

ADA/USD Long-term Trend –Bearish

- Supply zone: $0.0600, $0.0800, $0.1000

- Demand zone: $0.0100, $0.0080, $0.0060

ADA continues in its bearish trend in its long-term outlook. The pressure to the downside was sustained by the bears after confirmation of takeover at $0.03779 on 5th December. ADAUSD closed lower at $0.03390 in the demand area.

Increased bearish pressure led to the break at $0.03306 in the demand area on 6th December. This was the previous low made on 25th November as ADAUSD dropped further down to $0.02723 on 7th December.

Retracement to the upside saw ADAUSD at $0.03488 in the supply area. Rejection to further upward moves was seen around the 10-EMA as the bears gradually returned after the market correction.

The price is below the two EMAs with the 10-EMA acting as a strong resistance against upward price movement. The stochastic oscillator is in the oversold region with its signal pointing downward which suggests downward momentum in price in the long-term.

The 161.8 of the fib retracement may be the bears’ target which is at $0.01800 in the demand area.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.