This article looks at CryptoCompare's “November 2018 Exchange Review” research report (published on 6 December 2018), and highlights some of its key findings.

The first thing to note is the title of the cover page report says “CCCAGG Exchange Review.” This is because:

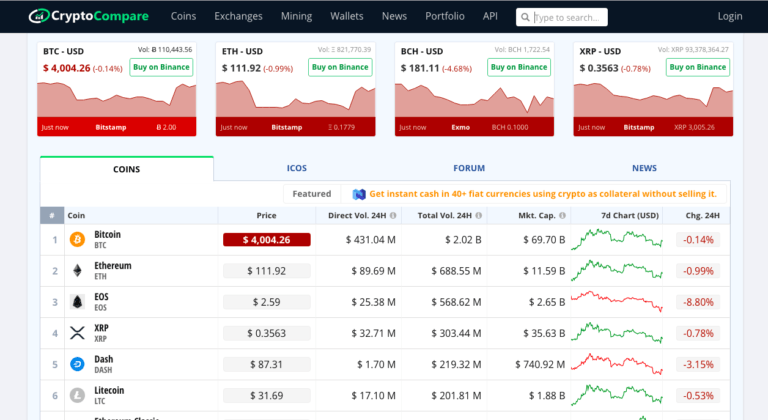

“CryptoCompare’s Aggregate Pricing Index (the CCCAGG) is used to calculate the best price estimation of cryptocurrency pairs traded across exchanges. It aggregates transactional data from more than 70 exchanges using a 24-hour volume weighted average for every cryptocurrency pair.”

Here are the current CCCAGG constituent exchanges (sized by 24-hour volume):

Bithumb Sees BTC/KRW Overake BTC/USD as Dominant Pair

Between 7 October and the 11 November, BTC to KRW represented 50% of bitcoin’s fiat trading volume, a 400% increase. This increase “stems from Korean exchange Bithumb’s spike in volumes.”

The top exchange by 24-hour spot trading volume was Bithumb with an average of over $1.24 billion; in second and third place were Binance and ZB with volumes of $641 million and $512 million respectively.

So, what caused the amount of BTC to KRW trading volume to increase so much?

Bithumb saw a 284% increase in volumes from the previous average of $323 million for the Sept/Oct period. This increase in volume comes after Singapore-based BK Global Consortium bought a controlling share in the exchange in recent months, and later implemented a series of airdrop competitions, raffles, rebates, and other programs designed to incentivize non-Korean users to sign up to the exchange and trade in exchange for rewards. The dramatic effect of these incentivised trading schemes can be seen in the chart below:

Bithumb has also implemented a form of trans-fee mining for certain users (trading past a specific volume is rewarded in the form of “Bithumb Cash” at a later date.) Last month, CryptoGlobe published an article that discussed the problem of trans-fee mining models causing “fake volumes” to get reported.

Major Crypto Exchange News in November 2018

- “Bithumb partners with an American fintech company to launch a US-based securities token exchange.”

- “Bitstamp announced a partnership with Cinnober, a leading provider of trading and clearing technology.”

- “The SEC brings charges against the founder of decentralized exchange EtherDelta for operating an unregistered national securities exchange.”

- “BitMEX launches a VC division, ‘BitMEX Ventures’.”

- “HuobiPro to open an office in Russia.”

- “OKEx changes settlement date of BCH futures causing outrage amongst traders.”

- “Coinone and Upbit go offline after an Amazon Web Services (AWS) network failure.”

Crypto Exchange Insights

- “From October to November, spot volumes constituted three quarters of total market volumes on average.”

- “Average futures volumes decreased 28% since last month on average, while average spot volumes remained steady.”

- “Bitmex’s Perpetual Bitcoin to USD Futures volumes continue to dominate the Bitcoin to USD futures market.”

- “Exchanges with taker fees represent just under 88% (5.16 billion USD) of exchange spot market volumes.” With TFM exchanges representing a large part of the remaining 12%.

- “Bithumb and Upbit represent the vast majority of South Korea’s volumes, while Binance and OKEx maintain dominance in Malta.”

- “On average, exchanges that offer only crypto-crypto pairs constitute approximately two thirds of the total spot trading market (~4.30 billion USD). Whereas exchanges that offer fiat to crypto pairs constitute a third of spot market volumes on average.”

- “Bithumb, ZB, CoinBene, EXX and FCoin attract significantly lower daily visitors than similarly-sized exchanges (including those ranked below 100,000 on Alexa).” Notably these exchanges operate incentivised trading schemes.

- “Exchanges itBit, Coinfloor, Bitfinex and Coinbase are among those that store the highest proportion of users’ funds offline.”

All Images Courtesy of CryptoCompare