On Monday (31 December 2018), Kelly Loeffler, the Chief Executive Officer of Bakkt, a subsidiary of the Intercontinental Exchange (ICE), announced that Bakkt, in its first round of fundraising, had received $182.5 million from several partners and investors who also “believe in the future of digital assets.”

In a blog post published a short time ago, Loeffler started by explaining who some of these partners/investors were:

“Boston Consulting Group, CMT Digital, Eagle Seven, Galaxy Digital, Goldfinch Partners, Alan Howard, Horizons Ventures, Intercontinental Exchange, Microsoft’s venture capital arm, M12, Pantera Capital, PayU, the fintech arm of Naspers, and Protocol Ventures.”

Next, she explained what Bakkt’s current focus was:

“Our work today is centered on driving institutional access for digital assets, along with merchant and consumer uses, and we’re already expanding on this vision, collaborating with great companies like Starbucks in these efforts.”

In particular, she said that she and COO Adam white were “focused on opportunities to provide new infrastructure, including the industry’s first institutional grade regulated exchange, clearing and warehousing services for physical delivery and storage.”

She also had some very good news:

“Clearing firms and customers have continued to join us as we work toward CFTC approval. We made great progress in December, and we’ll continue to onboard customers as we await the ‘green light.’”

As for when they will receive “regulatory approval for physically delivered and warehoused bitcoin” from the U.S. Commodity Futures Trading Commission (CFTC), she explained that Bakkt had filed the necessary applications, and it was now just waiting for the green light from the CFTC, which was originally expected (according to her blog post from November 20th) to take place next month.

However, according to a notice (titled “BAKKT BITCOIN (USD) DAILY FUTURES CONTRACT LAUNCH UPDATE”) posted on the Intercontinental Exchange website, it seems that the Bakkt platform’s launch has been postponed, with a new launch date set to be announced in early 2019:

“Following consultation with the Commodity Futures Trading Commission, ICE Futures U.S., Inc. expects to provide an updated launch timeline in early 2019, for the trading, clearing and warehousing of the Bakkt Bitcoin (USD) Daily Futures Contract. The launch had previously been set for January 24, 2019, but will be amended pursuant to the CFTC’s process and timeline.”

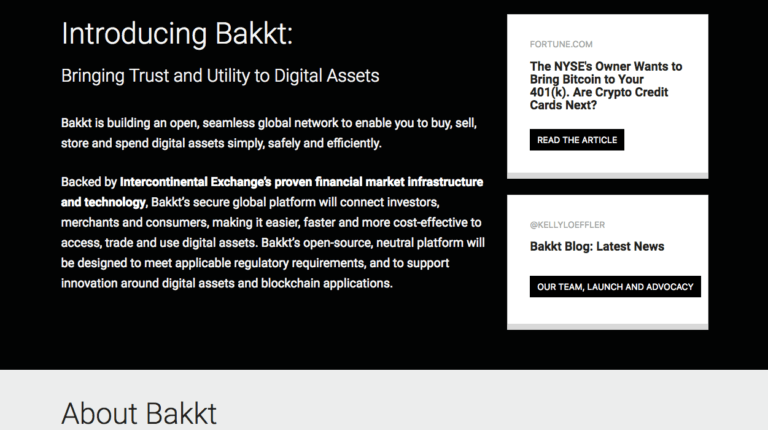

Featured Image Courtesy of Bakkt