Vietnam’s Ministry of Justice has reportedly been monitoring the country’s cryptoasset-related business activity, and has also prepared a report which contains an assessment of Vietnam’s current cryptocurrency regulations.

Surveying Local And International Crypto Markets

The report’s authors noted that they explored three different regulatory policies – which included making cryptoasset transactions legal based on certain conditions, completely “prohibiting” cryptocurrency-related activity, and using a “floating” or loosely defined regulatory framework for digital assets.

According to Vietnam’s Ministry of Justice, its officials have surveyed the local and global digital currency market. Nguyen Thanh Tu, the director of the nation’s Department of Civil and Economic Laws, said local authorities have carefully examined the pros and cons of regulating cryptocurrencies.

Tu also noted that Vietnam’s financial regulators will carefully review the current report on digital assets, and use its findings to help them conduct more research on how to properly regulate the emerging asset class.

Balanced Approach To Regulating Digital Currencies

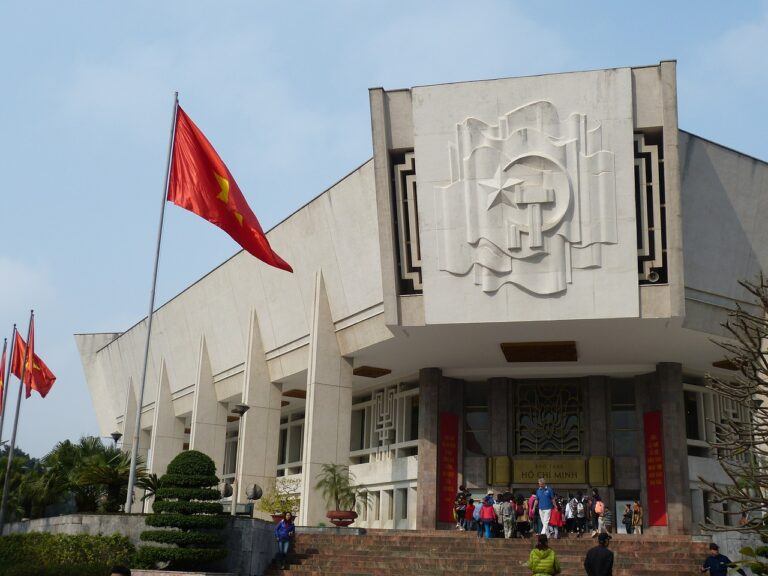

Government officials in the nation’s capital city, Hanoi, will decide which type of cryptoasset regulatory approach they want to adopt – based on the report submitted by the Vietnamese Ministry of Justice.

Vietnam’s federal government will also instruct the country’s relevant departments and ministries to begin drafting a regulatory framework for cryptocurrencies. Commenting on how he thinks digital assets should be regulated, Tu said authorities need to carefully consider the risks and potential of blockchain-based currencies.

Expressing views similar to government officials in other countries, Tu believes regulators must ensure consumers are protected from the fraudulent activities associated with digital currencies. He added that the Vietnam’s government must ensure that local investors are able to benefit from the technological innovation and legitimate investment opportunities in the nascent crypto industry.

Cryptocurrencies Are Not Legal Tender

Notably, Vietnam’s central bank has said that it does not consider cryptocurrencies to be legal tender. In July, the bank had issued a warning which stated that virtual currencies must not be used to make payments and that it would not offer banking services to crypto traders.

Vietnam’s securities regulator has also instructed local companies and other organization to refrain from dealing in digital currencies. Moreover, Nguyen Xuan Phuc, the nation’s prime minister, had ordered relevant agencies in July to work on formulating a legal framework for cryptoassets.

As CryptoGlobe reported in late June, Vietnam’s Ministry of Finance had called for a ban on all imports of bitcoin (BTC) mining equipment. At the time, the country’s regulators had said that the use of cryptocurrencies must be prohibited as they’re often used to finance illicit activities.