On Monday (19 November 2018), Taavet Hinrikus, the co-founder and chairman of UK-based cross-border money transfer company TransferWise, explained why his company is not yet using blockchain technology.

Hinrikus, who, until a year ago, was the former CEO of TransferWise, presented his thoughts on the potential application of blockchain technology for cross-border payments while giving an interview on the latest episode of Fortune’s online show “Balancing the Ledger”.

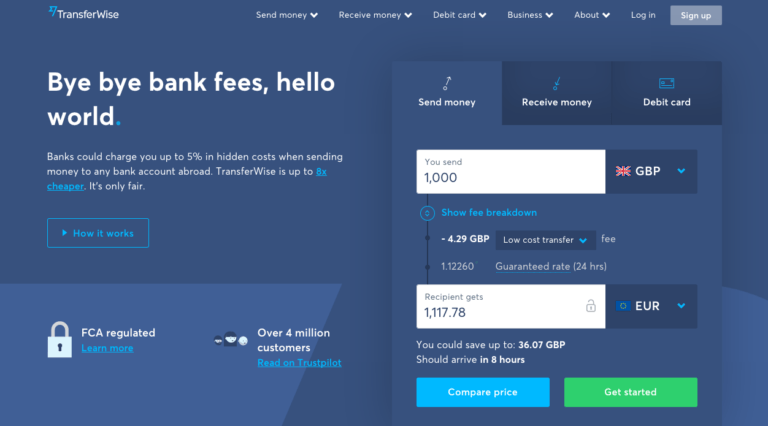

TransferWise was founded in the UK in 2011 by two Estonians friends who were working in London but needed to send money between UK and Estonia. And since they found the existing solutions to the cross-border payment problem too slow and/or expensive, they decided to quit their jobs and set up their own business:

“They’re both from Estonia. Taavet was the first employee at Skype, so he got paid in euros. But he lived in London, and needed pounds to pay the bills. Kristo worked for Deloitte and lived in London. He got paid in pounds, but had a mortgage back in Estonia. He needed to pay that in euros.

Every month they moved their money the old way – which wasted their time and money. So they invented a beautifully simple workaround that became a billion-dollar business.”

“Each month, they looked up the actual exchange rate on Reuters. Taavet put his euros into Kristo’s Estonian bank account, and Kristo topped up Taavet’s UK bank account using his pounds. Both got the currency they needed almost instantly, and neither paid an extra cent on bad exchange rates or unreasonable charges.

There was no waiting, no stress, and no extra costs. ‘There must be others just like us…’ they thought. The rest is TransferWise.”

Today, TransferWise, which counts Richard Branson and Peter Thiel amongst its investors, has over four million customers who “move more than $4 billion dollars every month, and “11 offices, with over 1,300 employees, across 4 continents.”

In yesterday’s interview on “Balancing the Ledger”, Hinrikus explained that right from the start, he and his fellow co-founder realized that they needed to build their own infrastructure:

“So, in every country, we try to connect to the payment network… And if we are lucky, we can do it in real-time in many countries [that] we are in… You can send money from Australia to UK… it'll be there in 15 seconds… If you are a customer of a bank, that seems like the future has arrived.”

He then explained why the SWIFT network, which is used by the vast majority of banks in the world for cross-border payments, is so slow:

“Banks use the SWIFT network, which is great [since] the money eventually gets there, but many people touch the money in between, and everyone takes a cut, everyone keeps the money for a day. Using TransferWise, because we plug in directly in every country, we can do it really quickly, and the cost is typically 10 times less than using a bank.”

Hinrikus was then asked if his company had evaluated the use of blockchain technology and/or cryptocurrencies. He replied:

“Yes, I mean, obviously, we've heard this dream many times from different people. However, if you start digging into it, you realize it may look great on paper, but in reality to make use of is really hard… So, we've looked at different blockchain technologies, but yet we haven't seen anything that enables us to do what we do in a way that is cheaper or faster.”

He was also specifically asked if he had looked at solution from Ripple and Stellar. He answered:

“Today… there's not widespread adoption for any of these. If every bank in the world was connected to the Ripple network, it would be amazing. Yet, how many banks today are using Ripple in production is a very short list… In that sense, we're big supports of Ripple or anything else… We know the Ripple team. We know the other teams. And if any of these gets enough adoption [such that] it actually materially helps us to do things cheaper and faster, we'd love to, but so far, we haven't found one.”

Although TransferWise aims to charge a fee of no more than one percent of the amount being transferred, it seems that if Ripple manages to significantly expand RippleNet, the attraction of its technologies might become too hard for TransferWise to resist, which could lead to them potentially being able to offer an even less expensive cross-border payment service.

Featured Image Courtesy of TransferWise