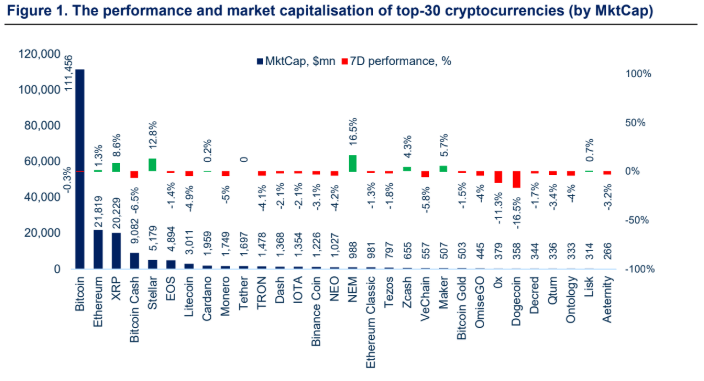

The total Crypto Market rose by 0.1%, and overall volume lost 6.5% over the past 7-days. Bitcoin is down by 0.3%, Ethereum gained 1.3%, XRP rose by 8.6%, and EOS is down by 1.4%. Best performers among top-40 crypto were NEM (16.5%), Stellar (12.8%), Ripple (8.6%) and Maker (5.7%).

With the notable exceptions of Bitcoin Cash, Stellar and NEM, the last week was largely uneventful for the prices of the top 20 digital assets. The building drama around the potential fork of the BCH led to an increase in price to nearly $640, before settling at around $500 at the end of the weekend. The price of XLM rose nearly 17% over the week after news of its massive $125m airdrop and NEM gained 17% due a partnership with Malaysia’s Ministry of Education’s launch of a degree verification platform built on NEM. The total crypto market cap reached a high last week of $220bn but today is back to last Monday’s levels of $211bn, with total volume around $12.8bn.

Cryptocurrency Markets

Stellar $125 Million Airdrop in Cooperation with Blockchain

The non-profit organization behind cryptocurrency Stellar Lumen, the Stellar Development Foundation, has announced a $125 million community “airdrop” or free distribution of XLM tokens, which will be distributed to all (~30 million) Blockchain (crypto wallet company provider) wallet users, who signed up. The $125 million airdrop is by far the biggest give away ever (#2 – Dfinity’s $35 million). “By working with Blockchain to increase the availability and active use of Lumens on the network, we will increase the network’s utility by many orders of magnitude”, announced Jed McCaleb, Co-Founder of Stellar, formerly of Mt.Gox and Founder of Ripple, too. The Web Summit, where the airdrop was announced by Blockchain CEO Peter Smith, attracted over 70,000 visitors, all of whom are eligible to receive Lumens via the airdrop.

Binance Launches Institutional-Grade Research Arm

The world’s largest crypto exchange Binance has announced the launch of its institutional-grade research arm which aims to increase transparency and improve the quality of the information. Binance will donate all listing fees to charity.

Bitmex Launches Venture Fund

Another crypto exchange Bitmex, which is the largest derivatives exchange by volume, says it is opening a Venture Capital branch Bitmex Ventures, led by Kumar Dandapani. Bitmex has already invested into the popular cryptocurrency portfolio tracker app Blockfolio.

More than 450,000 Bitcoins have been Seized to Date

The total amount of seized or confiscated bitcoin is now around 453,000 (2.6% of the total circulating supply), from which more than 85% of seized bitcoins originate from two cases – 174,000 worth of BTC seized from online black market Silk Road by US officials and SELEC’s 200,000 BTC seized by Bulgarian authorities. Analysis points out that the amount of U.S.-seized bitcoins is approaching 200,000 BTC, from which the majority was sold for $151 million.

Additional Bribery Case Found For Tether’s New Bank, Deltec

After leaving Noble Bank of Puerto Rico, it was confirmed that Bitfinex found a new banking partner, Deltec Bank & Trust. Deltec even went as far as to confirm with an official letter that Bitfinex was banking with them and that they have the required reserves. Breaker Magazine recently reported that Deltec has been named in two global bribery cases. A previous Bahamian news report claims that Deltec is under investigation by the U.S. government for reportedly receiving $12M in bribes from a Venezuelan official.

Days later, Breaker also found that former Brazilian official Paulo Vieria de Souza, under investigation for the Odebrecht corporate bribery scheme, was possibly moving money through Deltec Bank & Trust. CryptoGlobe previously reported on this Brazilian case.

Bitfury raised $80 Million

The second largest cryptocurrency hardware technology and mining firm Bitfury Group, has just closed an $80 million funding round with participation from Galaxy Digital and Korelya Capital.

Augur’s Record Market Exceeds $2 Million Bets in Total

The decentralized betting platform built on Ethereum has launched a market for “which party will control the house after 2018 U.S. Midterm Election?” and more than $727,000 or a little over 3,500 ETH are at stake, which has pushed the total bets on the platform to exceed $2 million in total. Launched in July as one of the most promising dapps, with only 19 to 56 daily users reported in October, these numbers are indicating it’s a struggle for Augur to attract new users and this is mainly due to its complicated user experience.

Bitsamp’s New High Speed Matching Engine

Cryptocurrency exchange Bitstamp is getting a new matching engine developed by Cinnober, a global exchange and clearing technology provider. The new system will drastically increase the exchange’s capacity to match orders, which is especially important in periods of high market activity like last December’s rally. “Our order matching speed is expected to become 1,250 times faster, while throughput will increase by 400 times”, Bitstamp’s CTO David Osojnik added.

Spanish Bank Puts $150 Million Syndicated Loan on Ethereum

Banking giant BBVA with its co-lenders Japan’s Mitsubishi UFJ Financial Group and France’s BNP Paribas, has put a $150 million loan for Spanish national electric grid firm Red Electrica on Ethereum blockchain, which according to BBVA, increases transparency, reduces the process from a couple of weeks to one or two days, and also cuts out operational costs.

Cryptocurrency Regulation

SEC Charges First Crypto Exchange

The SEC has charged US-based cryptocurrency exchange EtherDelta with operating an unregistered security exchange. According to the Co-Director of SEC Division of Enforcement, Stephanie Avakian, “EtherDelta had both the user interface and underlying functionality of an online national securities exchange and was required to register with the SEC or qualify for an exemption”. Founder of EtherDelta, Zachary Coburn, has already settled the charges, paying $300,000 in disgorgement, $13,000 in pre-judgement interest and $75,000 penalty. What has really happened and why there are likely many more enforcements on the way – crypto advocate Jake Chervinsky, has once again brilliantly re-capped the whole situation on twitter. Most notably, the SEC is currently aiming for smaller fishes, most likely to build enough precedents ahead of going for bigger whales. A very important question still remains unanswered though, which tokens are securities?

D.C. Fintech Week with Two Crypto-Related Outcomes

Although it is not confirmed exactly when, the SEC director of Corporate Finance, William Hinman, said that the SEC is planning to publish ICO guidance in “plain English” for any project which is unsure whether their token qualifies as a security. “If someone’s offering an instrument for money or other consideration to a third party, and that third party expects the offerer to generate a return or something that will increase the value of the coin or token or whatever they want to call it, and there’s that expectation of return, we’re generally going to see that as a securities offering,” Hinman said.

Same event, different speaker, this time CFTC’s Chairman J. Christopher Giancarlo highlighted distributed ledger technology (DLT/blockchain) and how it might be useful for improving the regulation of derivatives markets.

Colorado and Texas Regulators Strike against Crypto Sales

Last week’s regulation recap ends with another case from the USA (indeed a productive week for US regulators), where the Colorado regulation unit “ICO Task Force” took action against four ICOs due to an unregistered securities sale. The avalanche of enforcements is affecting even non US-based crypto firms too. Last week, Australian cloud mining firm PTY LTD, has received a cease and desist order from Texas State regulators due to several violations such as sale of unregistered cloud mining contracts, unregistered securities broker and potential conflict of interest, as CryptoGlobe writes.

Swiss Finance Regulator is Giving Tough Guidance to Banks Trading Crypto

Financial Market Supervisory Authority (FINMA) has issued a confidential letter to accountancy organization EXPERT Suisse, where FINMA advises banks and securities dealers to assign a “flat risk weight of 800% to cover market and credit risks” against crypto assets, meaning that, if the current price of bitcoin is $6,000, institutions would have to value each coin on their books at $48,000 when deciding on an adequate level of buffer. FINMA has also set a crypto-trading cap at 4 percent of a bank’s total capital, and said they must report to the authority if they reach that upper limit.

Security Tokens

Lykke and Nxchange Launch Tokenized Securities Exchange

Swiss-based crypto exchange Lykke and fully regulated (Netherlands) securities exchange platform Nxchange, are partnering to launch a fully regulated tokenized securities exchange, where Lykke, for its equity stake in Nxchange, will provide investment capital, blockchain technology, crypto trading infrastructure and financial engineering expertise. Nxchange on the other hand, will bring regulatory compliance and governance expertise, which when combined will allow for tokenization of equities, bonds, loans or other investment products on a regulated blockchain environment.

StartEngine Announces New ERC-1450 Token Standard

Equity crowdfunding platform StartEngine has introduced the new ERC-1450 token, which can be seen as a standard for creating digital stock certificates. ERC-1450 will require an SEC registered transfer agent, who acts as a record keeper (in this case it is StartEngine Secure LLC) to create and process the tokenized securities. StartEngine will be using the ERC-1450 standard to list tokenized stocks and equity on their crowdfunding platform. Currently, ERC- 1450 tokens have been issued to all 3,500 StartEngine shareholders and the 165 eligible companies that use StartEngine.

Issuance Acquires CrowdfundX

Marketing platform for digital securities Issuance, has executed LOI to acquire fintech marketing firm CrowdfundX with the focus on STOs and RegA+ IPOs. CrowdfundX has a database of 500,000 retail investors and clients such as tZERO and KODAKone. With the recent announcement of a listing agreement with OpenFinance and strategic partnership with Securitize, Issuance is slowly becoming one of the main players in the digital securities world.