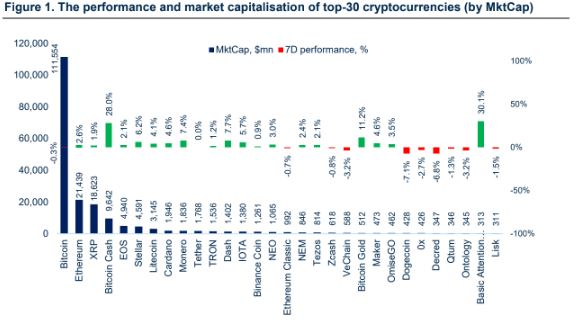

The total Crypto Market rose by 1.3%, and overall volume spiked by more than 40% over the past 7-days. Coinbase listed Basic Attention Token which is up 30% on the week, Binance Uganda had a successful launch and Global Digital Finance published their Code of Conduct.

After the general crypto market started the last week with a sell off, where the total market cap fell by more than 3% on Monday, the cryptocurrency market has been in recovery mode since, and all 20 major coins are in a green zone. Total market capitalization has settled below $212 billion versus $201 billion a week ago, with volume of $14 billion, representing a 40% increase versus the previous Monday. Best performers among top-40 crypto were Basic Attention Token (30%), Bitcoin Cash (28%), Dash (7.8%) and Monero (7.3%). Last week’s recovery was surprisingly not led by Bitcoin, but by its younger relative Bitcoin Cash, with almost 38% increase from its weekly lows due to a hard fork scheduled for November 15th.

Cryptocurrency Regulation

UK Government Publishes Crypto Regulatory Report

The UK Cryptoasset Taskforce, which is composed of FCA members, The Bank of England and HN Treasury, published an up-to-date report on Monday, where a new range of crypto assets’ regulatory steps were outlined. The Taskforce’s “immediate priority is to mitigate the risks associated with the current generation of crypto assets; the Taskforce considers other applications of DLT to have the potential to deliver significant benefits in both financial services and other sectors. “The authorities do not believe there are regulatory barriers to further adoption of DLT”. However, according to the report, the FCA is going to discuss a potential ban on the sale of derivatives like Bitcoin to retail by the end of this year, and priorities for early 2019 are tax guidance and formalization of rules around UK-based crypto projects and crypto assets in general. The UK will however maintain a tech-neutral approach, meaning that no specific legal framers will be introduced for DLT (distributed ledger technology).

Hong Kong Will Regulate Crypto Funds under Existing Securities Regulation

Hong Kong’s financial regulator (SFC) will regulate Hong Kong-based investment funds which allocate more than 10% of their gross portfolio into virtual assets. Direct or indirect investments, such a funds, will have to be licensed and registered in order to officially operate within Hong Kong. Jehan Chu, Managing Director of one of the largest Asian funds Kenetic Capital, is welcoming the SFC decision, “which shows that the SFC is willing to support the growth of the crypto and blockchain eco-system in a safe and sustainable manner.”

India Considers Banning Private Cryptocurrencies

At the meeting of The Financial Stability and Development Council (FSDC), the high level committee chaired by the Secretary of Economic Affairs briefed the council on the potential harms of private cryptocurrencies and also stated they intend to come up with an appropriate legal framework to ban use of private crypto currencies in India. No timeframe has been set yet. From the global standpoint, India is one of the most active “crypto banners”; last month saw the largest exchange Zebpay shutdown as well as crypto ATMs being seized by the police and no bank is currently allowed to provide any services to crypto-based projects whatsoever.

Cryptocurrency Markets

Bitstamp Acquired by NXMH

The EU’s largest (by volume, 3 million users) and oldest (founded in 2011), crypto exchange Bitstamp, was acquired by Belgium-based, $1 billion AUM, private equity company NXMH, which is a subsidiary of the global video game company NXC. The largest shareholder, Pantera Capital, will retain its 6% stake. Bitstamp’s founder and CEO Nejc Kodrič will retain a minority stake but will continue to run the firm’s operations. The terms of the deal were not disclosed.

Morgan Stanley Updates its Crypto Report

Morgan Stanley has released a 50-page report mapping the current state of cryptocurrencies. The report, called “Update: Bitcoin, Cryptocurrencies and Blockchain”, starts with the bitcoin thesis evolvement from digital cash to the new institutional investment class, and continues with correlation among the cryptocurrencies, stable coins, ICOs, bitcoin issues, institutional involvement, energy consumption, regulation and finally blockchain technology.

Coinbase Lists Basic Attention Token

Coinbase Pro has added support for Brave browser’s native token BAT. Announced on Friday, the coin will be added in four stages and New York-based customers will be initially restricted in trading BAT. BAT has surged more than 28% prior to the news to a 3-month high at $0.33.

Binance Signs 40,000 Customers within First Week in Uganda

Binance Uganda signed almost 40,000 users in the first week of operations. It’s a country, where, according to Stanford research, 74% of household are unbanked, and shows that no matter what the general market condition, demand is huge.

Global Digital Finance Releases Code of Conduct

A non-profit industry body Global Digital Finance (GDF), created to “drive acceleration and adoption of digital finance”, has released a Code of Conduct, Taxonomy, as well as introduced 7 founding members, composed of Circle, Coinbase, ConsenSys, r3, Diginex, DLA Piper and Hogan Lovells. The Code of Conduct was created out of “contributors from more than 200 firms in the global crypto asset community” and is an industry-led “shared rulebook”, which will allow companies to demonstrate that they “abide by ethical and professional standards in their conduct with clients, money handling, risk management and market price”, as CryptoGlobe noted.

Microsoft Partners with Nasdaq to Implement Blockchain Technology

Microsoft announced its new cooperation with Nasdaq’s Financial Framework (NFF). It will integrate Microsoft’s Azure with NFF and thus create a blockchain system, which helps different technologies work together for Nasdaq customers, as it might make it easier to match buyers and sellers or manage the delivery, payment and settlements of transactions, according Bloomberg.

Last Week’s Funding Report

CryptoKitties raised $15 million from Venrock, Google Ventures, a16z and others; Paradigm invested $30 million into StarkWare’s zero-knowledge proofs to keep information private; ConsenSys has acquired an asteroid mining company, and lastly, Coinbase has secured $300 million in Series E round (valuation at $8 billion), led by Tiger Global Management, Y Combinator, Polychain, a16z and others.

Happy 10th Anniversary Bitcoin!

On 31st of October 2008, Mr. Satoshi Nakamoto published a detailed paper, describing how Bitcoin could work. 10 years later, look where we are Satoshi! If you are still having a hard time totally grasping the purpose and future of Bitcoin, “The Ultimate Bitcoin Argument” is the read for you.

Security Tokens

Securitize Partners with BnkToTheFuture

A compliance platform for the issuance of digital securities, Securitize and registered securities online investment platform BnkToTheFuture, has announced a partnership which gives Securitize’s customers access to an established investment platform and also provides BnkToTheFuture with preferred status for their fundraising customers on the Securitize platform. BnkToTheFuture will also adopt Securitize Ds Protocol on their upcoming security token exchange. BnkToTheFuture has so far invested more than $600 million in over 100 companies, the likes of Kraken, Bitfinex, Shapeshift and others.

Bithumb Plans to Launch Security Token Exchange

South Korea-based crypto exchange Bithumb, in partnership with US SEC accredited crowdfunding platform SeriesOne, will launch a security token exchange within the United States during the first half of 2019.

JP Morgan to Tokenize Gold bars

One of the largest US banks, JP Morgan, has announced its plans to tokenize gold bars on its own blockchain enterprise Quorum, which is built on Ethereum. The development is seen as a potential way for more-sustainable miners to earn premium on the global market as the gold bar will be electronically tagged and tracked from the mine to endpoint.

Harbor and BitGo to Transform Private Securities with Blockchain

Andreessen Horowitz and Pantera-backed security token issuance and fundraising platform Harbor, have announced a partnership with crypto custodial BitGo, who will “take care” of companies crypto, and which has raised the funds on a Harbor platform.

Myths and Reality of Security Tokens

Delivered at the Crypto ICO Summit in Zurich by Jesus Rodriguez, Chief Scientist and Managing Partner of Investor Labs, “The Future, Myths the Realities of Security Tokens” presentation talks about the current state of the security token market and problems which needs to be addressed in the near future. The slide deck can be found here.