As bitcoin and altcoin prices remain in the doldrums following a miserable period for crypto markets, it is perhaps unsurprising that mainstream financial media seem to be falling over themselves to disparage the cryptocurrency.

“Jamie Dimon and Warren Buffett Have the Last Laugh on Bitcoin” declared Bloomberg as bitcoin slumped to its lowest price since July 2017.

'Fuddy-duddy' has the last laugh: Warren Buffett was right on Bitcoin all along” reads the Sydney Morning Herald, while the Financial Times’ video “Bitcoin: why the dream is dying as price tanks to under $5,000” seems to capture the sentiment of much of the media.

But isn’t this whole episode a bit of a déjà vu?

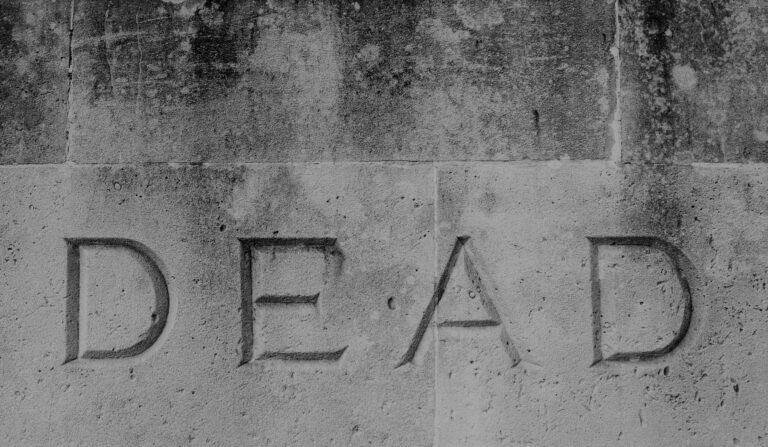

Bitcoin Obituaries

This is by no means the first time that bitcoin has been declared “dead.”

Bitcoin Obituaries is a fascinating site that tracks the number of times media have declared the cryptocurrency’s death.

Charting every news headline since the early days of bitcoin, the site records 322 instances stretching back as early as December 2010, when the Underground Economist confidently explained “Why Bitcoin can’t be a currency.”

It even features an “Obituary generator” section offering to help struggling authors with their obituary titles:

Need a title for your Bitcoin obituary? Just click on “generate” and we'll randomly create one for you from over a hundred obituaries we have in our database.

One Reddit user has taken things even further however, plotting every article on a graph of bitcoin price over time, highlighting some standout headlines along the way:

It seems that we’ve been here before.

Nearly every major peak and trough has brought with it a pronouncement of death, often accompanied by a rationale as to why bitcoin and crypto cannot succeed. Will this cycle be different?

Burnout

The latest market slump is unquestionably troubling. Not only are investors who rode the hype of late 2017 now understandably feeling burnt, but it makes some of the ‘expert’ predictions of last the last bull run seem absurd – if not outright irresponsible.

The experience however, has if nothing else has taught investors a lot. In this vein, a lengthy post entitled “How to move forward from the crash if you're a bagholder” on popular subreddit r/cryptocurrency explains where many investors went wrong, but tempers the criticisms with some positivity:

This is also a good learning opportunity…A good thing to do during catastrophic losses is to honestly access why you got suckered into buying high in the first place. Most people here are young, and this is a valuable lesson in why you shouldn't follow the herd. Everyone is a genius in a bull market, everyone is chasing the next hype. Crypto tends to attract people looking for a get-rich-quick-without-effort crowd, but it takes some mental effort to understand this beyond the buzzwords. Take the time to understand the fundamental reasons why an asset has value and what factors would drive its rise once the hype dies down. What makes Bitcoin valuable, what makes some of the other cryptoassets valuable? If those fundamentals in some way changes, so should your opinion.

Sentiments shared by bitcoin veteran Andreas Antounopoulos:

If you ask “why has crypto gone down so fast” answer is the same as “why did crypto go up so fast last year”.

New tech, price mostly driven by speculators – means that the price reflects the price, instead of tech fundamentals (which exist & are strong but are hard to measure).

— Andreas M. Antonopoulos (@aantonop) November 21, 2018

Whatever your reason for being in crypto, now is the time for:

– Compassion

– Patience

– RespectLot's of people have lost lots of money recently and it is not helpful to make empty promises, share shitty memes, or criticize others' choices. #bekindorshutup

— Andreas M. Antonopoulos (@aantonop) November 19, 2018

Media Quick to Eulogize

It’s understandable that those outside the crypto world feel some sense of vindication (and perhaps smugness) watching the mad bubble of 2017 definitively pop.

It is surely an open question as to whether bitcoin will ever again see the heady heights of December 2017, and it seems lacking in imagination to think otherwise.

What remains suspicious however, is the speed with which the media is willing to time and again declare bitcoin dead. The same media that capitalized upon the hype of last autumn seems strangely sure that Warren Buffet was right all along.

How well the headlines this week will age remains to be seen, yet if the chart above teaches us anything it’s that so far, reports of bitcoin’s death have been greatly exaggerated.