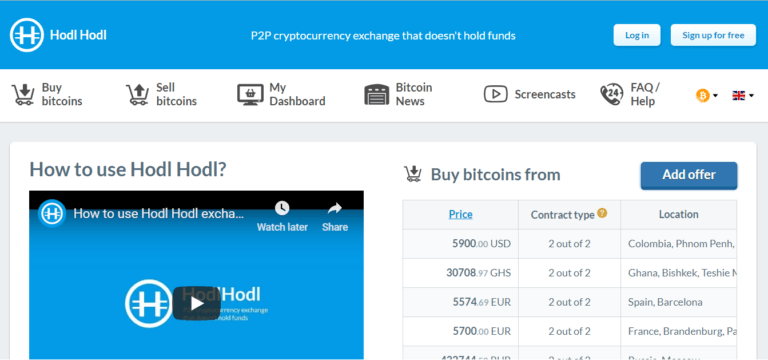

Peer-to-peer digital asset exchange, Hodl Hodl, which does not hold customers’ funds, has announced the launch of an over-the-counter (OTC) trading desk. The new crypto exchange has been developed and deployed through a partnership with European Union (EU) licensed brokerage firm, Tenbagger.

According to its official website, Tenbagger operates an Estonia-based and EU regulated digital currency exchange service – which will be used by Hodl Hodl to “match and guide counter-parties, allowing [users] to buy and sell bitcoins [BTC] with same day settlement” at “competitive rates.”

Eliminating Custodianship & Counterparty Risks

Notably, Hodl Hodl is the first crypto exchange to launch an OTC platform the offers non-custodial escrow services to BTC traders. Explaining why their new service is important, Hodl Hodl’s management said:

There has been a vibrant OTC Bitcoin trading market operating in parallel to the existing exchanges, but none of them are offering non-custodial escrow services for cryptocurrencies which would eliminate the risk of losing funds.

The company’s managers added that their crypto OTC escrow service uses the Bitcoin blockchain for transactions – which is considered the most secure digital asset network as it has by far the largest number of participants working (mining) to validate blocks.

Moreover, Hodl Hodl’s OTC service aims to eliminate custodianship and counterparty risk while also taking advantage of the high level of security and network effect of Bitcoin’s ledger – by using it record transactions.

Bitcoin network’s 99.98% uptime since the past 10 years also makes it ideal for executing OTC trades which eliminate intermediaries and custodians from transactions – as they allow the seller and buyer to interact directly with each other.

New Service Will “Not Affect” Non-KYC Compliant Exchange

Additionally, bitcoin’s spot price is not affected by OTC trades, unlike when it’s traded on centralized exchanges. As mentioned, all BTC trades are settled within 24 hours and Hodl Hodl’s platform offers 24/7 customer support services.

As explained by the company’s Medium post: “For each trade, [Hodl Hodl’s exchange] creates a unique multisig escrow account on Bitcoin’s blockchain, ensuring transparency and the highest level of security.”

Notably, the launch of the new crypto escrow service will “not affect” the company’s bitcoin (BTC) and litecoin (LTC) exchange – which were introduced in early 2018. Per the announcement, Hodl Hodl is “the only non” know-your-customer (KYC) / anti-money laundering (AML) and “non-custodial P2P platform suitable for any type of trade — small or large.”