Estonia, one of the world’s most “digitally advanced” societies, has reportedly issued over 900 licenses to cryptocurrency and blockchain-related firms in the past year.

500 Crypto Exchange Licenses, 400 Wallet Service Licenses Issued

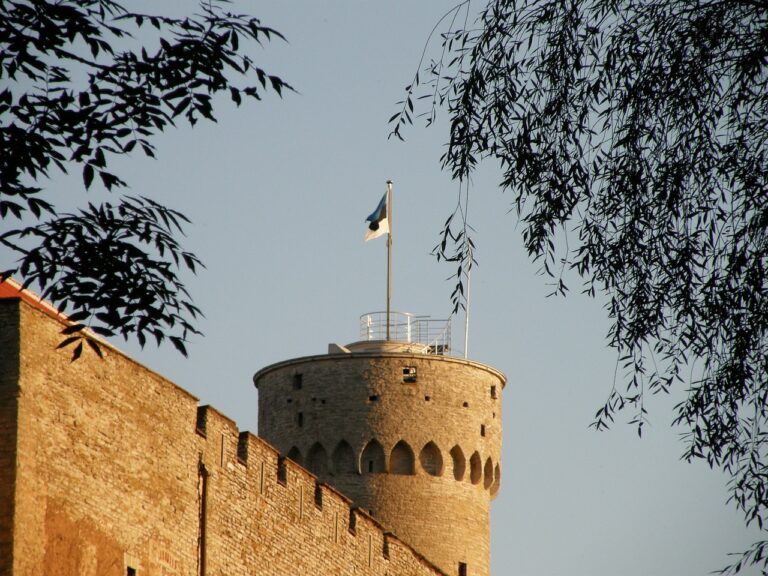

Government officials in the Baltic nation have adopted a progressive approach to regulating cryptoassets, however, local companies have complained that Estonia’s financial institutions are still reluctant to provide standard banking services to crypto-related businesses. Notably, Estonia was among the first countries in Europe to develop regulations and legalize crypto-related transactions.

At present, there are about 500 licenses Estonia’s authorities have issued to firms operating cryptocurrency exchanges. Additionally, the country’s financial regulators have authorized over 400 crypto wallet services to offer their products to Estonian residents.

Nikolay Demchuk, an associate at local law firm Njord, pointed out that the nation’s Register of Economic Activities suggests that obtaining regulatory approval for providing cryptocurrency-related services in Estonia is an easy-to-follow and simple process.

Two Weeks To Be Licensed

Moreover, the Estonian Financial Intelligence Unit (FIU), the main organization responsible for issuing financial services-related licenses, requires up to 30 days to review applications for businesses. In most cases, however, the FIU takes only about two weeks to grant approval to crypto firms looking to establish their headquarters in Estonia.

While crypto-related licenses are issued fairly quickly, the nation’s regulators do require that businesses officially begin conducting operations within a few months after being approved for offering such services. Failure to start business activity may result in the license being revoked.

The requirements outlined by Estonia’s authorities include complying with the standard know-your-customer (KYC) and anti-money laundering (AML) checks.

Companies Licensed In Estonia Are Legally Operating In The EU

Companies licensed by Estonia’s government have actually been given regulatory approval to operate in the wider European Union jurisdiction – as Estonia is currently a member of the EU.

As mentioned, cryptocurrency-related firms have found it challenging to open bank accounts in Estonia, despite the country’s relatively progressive laws. Commenting on the issue, Demchuk said:

Opening a bank account is the biggest problem facing crypto companies. Estonian banks are not yet ready to serve clients operating with cryptocurrency.

Potential Risks Associated With Cryptocurrency-Related Businesses

Presumably, Estonian financial institutions may be concerned about the potential risks associated with crypto and blockchain-related businesses.

As CryptoGlobe reported, UK’s financial regulator, the Financial Conduct Authority (FCA), recently warned that GMT Crypto (http://www.gmt-crypto.com) has presented fake FCA-authorization information on its website.

According to the FCA, GMT Crypto is misleading investors by listing (and associating itself with) the official company address and reference number of established UK-based financial firm, GMT Communications Partners LLP.