San Francisco-based cryptocurrency exchange Coinbase has recently launched an over-the-counter (OTC) trading desk for institutional investors, in a move made “just reacting to client demand.”

According to an interview Coinbase’s Head of Coverage Christine Sandler did with Cheddar, the cryptocurrency exchange is even considering amalgamating its custody and OTC trading services. The company revealed it was planning to launch an OTC desk in May.

Sandler stated:

We launched our OTC business as a complement to our exchange business because we found a lot of institutions were using OTC as an on-ramp for crypto trading. We felt this was a huge benefit to our clients to actually leverage both our exchange and our OTC business.

The firm’s Coinbase Custody service can be used by investors who wish to have over $10 million worth of cryptocurrency stored on the platform’s wallets. Those who invest such large amounts should be interested in OTC trading, to exchange directly with the exchange. Square, the firm behind the popular Cash app, has for example moved its BTC trading service to OTC desks.

During her interview with Cheddar, Sandler was asked how Wall Street’s approach fits with Coinbase’s open-economy philosophy. She noted that the revolution “began on the retail side, and we absolutely love and respect and take care of our 25 million retail clients, but we want the ecosystem to become broader and less volatile, and we want it to become a less homogenous marketplace.”

As such, she added, the market needs new participants. Some of these are institutions and market makers who ultimately benefit all of Coinbase’s clients, presumably through the added liquidity. As for institutional investors’ views of the recent market downturn that saw bitcoin go under the $4,000 mark for the first time since September of 2017, she stated:

From our crypto-first clients, we’re hearing that nothing has changed with respects to the technology, and they’re still absolutely committed to crypto, they’re absolutely committed to the technology.

The bear market significantly affected Coinbase’s business, as its traffic plummeted since last year’s highs. As reported, it went from a 126 million monthly visitor high to a 28 million low in June, according to available data.

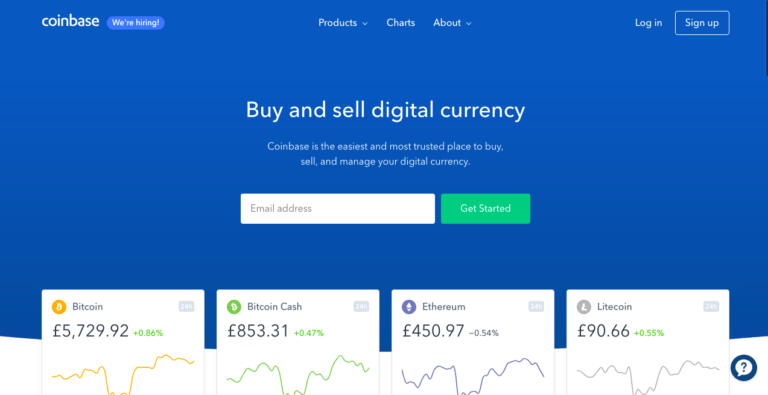

Coinbase was launched back in 2012, and has gained millions of users since them. Most of its users are retail investors who got into crypto since it launched, but it has over the past few months been targeting institutional investors. Recently, it assured these it’s got “core principles,” and made its index fund more attractive by halving its fee from 2% to 1%.

As Finance Magnates points out, Coinbase has been hiring talent from organizations like Barclays, the New York Stock Exchange, Charles Schwab, and more. As CryptoGlobe covered, the firm has earlier this year launched several new institutional grade products and services.