BitGo, an enterprise-grade custodial cryptoasset wallet service, has added the ERC20-based Gemini Dollar (GUSD) to its storage options. GUSD joins True USD (TUSD), Circle’s USDC and Paxos (PAX) to be the fourth stablecoin storable on the high net-worth service.

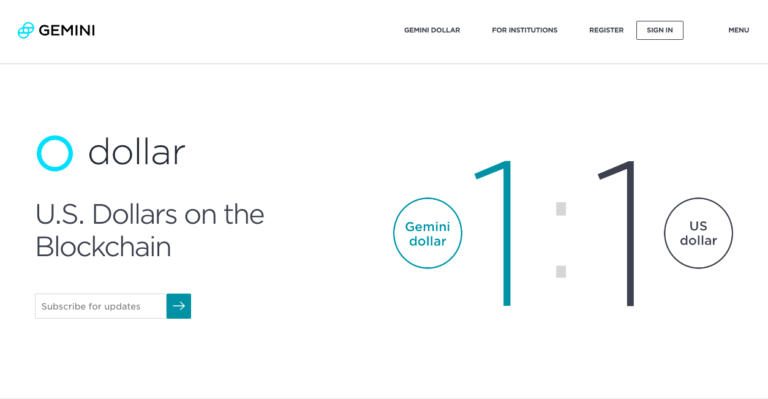

GUSD is issued by the Gemini digital asset exchange, a New York State Department of Financial Services-regulated entity. GUSD tokens are backed one-to-one with US dollar reserves.

Once dominated by the ever dubious Tether (USDT), the field of stablecoins has grown prodigiously in 2018, in terms both of quantity of available assets, and of exchanges and wallets adding them to use.

As CryptoGlobe has covered extensively. a number of companies and exchanges have onboarded the four above-mentioned coins, although USDT still makes up the lion’s share of market capitalization – GUSD enjoys only a paltry $15 million market share versus USDT’s $1.67 billion.

What’s more, GUSD has come under criticism for being non-immutable, and capable of transfer reversal or suspension by Gemini at the request of law enforcement or essentially any other discretion.

Last month, concerns over Tether’s banking relationships presumably caused fluctuating Tether prices and bitcoin/USDT pairings to trade at an all-time-high premium against bitcoin/USD pairings.

The Huobi exchange, also last month, released its own on-exchange stablecoin that allows withdrawing of any of the four above-mentioned stablecoins, to “eliminate the need to choose between multiple stablecoins” on the platform.

Deep pockets

BitGo, a member of Digital Currency Group (DCG), does not sell its services cheaply. BitGo’s Custody service has a minimum $10 million capital requirement, and its Business Wallet requires a $1 million minimum transaction volume. The California-based company offers offline (cold) wallet storage and multi-signature transactions service.

DCG is itself a heavy hitter, counting former US Secretary of the Treasury and President of Harvard University Larry Summers as its board advisor.