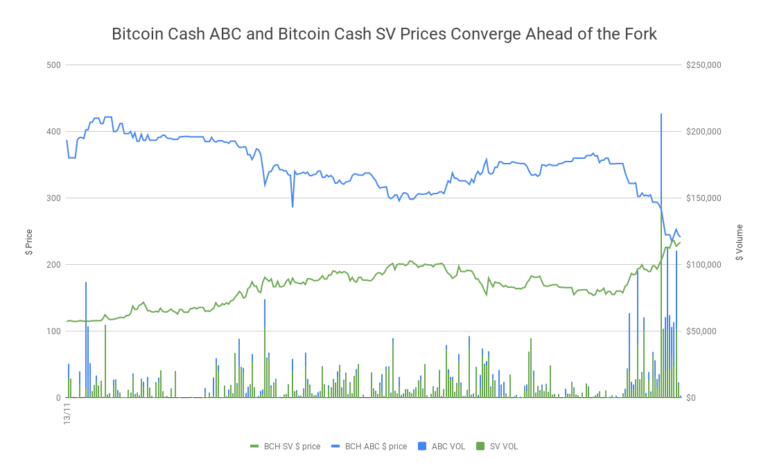

The two rival bitcoin cash futures tokens – BCH ABC and BCH SV – have seen their prices rapidly converge – with BCH SV briefly surpassing ABC in value this morning (Nov 14th).

With the upcoming fork for Bitcoin Cash scheduled for tomorrow (Nov 15th), BCH ABC has seen a dramatic slump in price in the last 24 hours – dropping over 38%, while Craig Wright’s BCH SV has seen an enormous surge of over 100%.

At the time of writing futures for BCH ABC are trading at $246.84 while SV is trading at $228.

Hash Power Moving Price

With Roger Ver and Bitmain backing bitcoin cash ABC, it was originally seen as likely to be the clear victor in the struggle.

With SV advocate Craig Wright however, revealing on Saturday (Nov 10th) in an interview that BCH SV owns a majority of the hash rate, the markets have reacted strongly, seeing the prices of futures for the two coins rapidly converging.

Last night (Nov 13th) saw a ‘flash crash’ on BCH ABC futures on Bitmex, with the price for ABC dropping over 62%:

Was just a flash crash on the Bitmex BCHZ18 contract.

There were millions of liquidations like thishttps://t.co/PB7OAAzwRE pic.twitter.com/lc3xOSstqu

— lowstrife (@lowstrife) November 13, 2018

A First for Crypto

The scheduled hard fork stems from starkly contrasting visions of the future of Bitcoin Cash.

Proponents of BCHSV plan to increase the blocksize to 128MB, whereas the ABC camp intends to maintain the 32MB size, while implementing technical changes designed to facilitate “atomic swaps” (a means to swap cryptoassets without using an intermediary).

While it remains to be seen which faction will emerge the clear victor, the battle has seen a significant first for cryptocurrency markets.

This is the first time that a scheduled fork has seen such parity in price ahead of the forking date. This raises questions for exchanges about the security of each chain post-fork as 51% attacks are now more feasible. With forks of prominent cryptoassets in the past, a clear frontrunner has tended to emerge in terms of price, hash power and community support – as was the case of the ETH fork away from ETH Classic in 2015, and Bitcoin and Bitcoin Cash last year.

In this case however, it seems that the eventual victor – or even if there will be a clear winner at all – remains uncertain. What does seem certain however, is that the entire episode has been damaging for Bitcoin Cash.