On Friday (2 November 2018), crypto exchange Coinbase announced that its trading platform for professional/experienced traders, Coinbase Pro (pro.coinbase.com), had added support for cryptoasset Basic Attention Token (BAT).

The post on Coinbase’s blog explained that:

- After 1pm PT (i.e. 20:00 UTC) on November 2nd, Coinbase will be accepting BAT deposits at Coinbase Pro.

- This will continue for “at least 12 hours prior to enabling trading.”

- “Once sufficient liquidity is established, trading on the BAT/USDC order book will start.”

- “Users may convert their USD to USDC with one click within the Pro interface.”

- Initially, BAT trading will not be available to residents of New York state.

- BAT will become available on Coinbase Consumer (Coinbase.com) and on the Coinbase mobile app (for iOS and Android) at a future date.

As when 0x (ZRX) was added to Coinbase Pro, there will be a four stage launch:

- Transfer-only (customers can only transfer BAT into their Coinbase Pro account): started at 1pm Pacific Time on November 2nd.

- Post-only (customers can “post limit orders but there will be no matches or completed orders”).

- Limit-only (” limit orders will start matching but customers will not yet be able to submit market orders”)

- Full trading (in this final stage, all trading services are available).

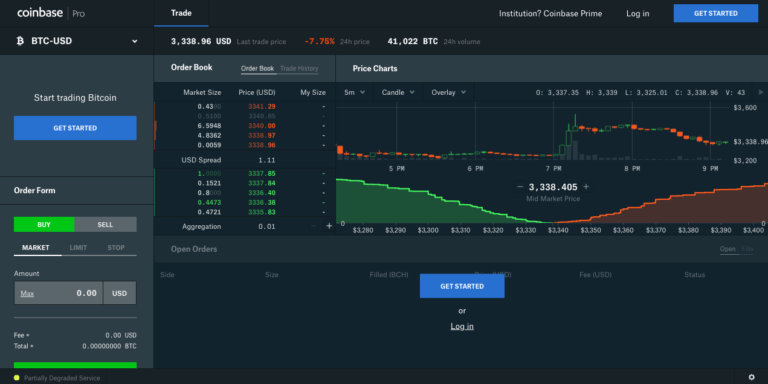

It seems that Coinbase Pro is only offering (at least, for now) only one trading pair — BAT/USDC — as can be seen from the screenshot below (no pricing data is shown for BAT since, at press time, we are still at stage one, the “transfer-only” stage, of the launch process):

At press time, according to data from CryptoCompare, BAT, only the second ERC-20 token to get added to Coinbase Pro, is trading at $0.3060, up 19.11% in the past 24-hour period. This is the one-day chart for BAT:

Featured Image Courtesy of Coinbase