On Monday (29 October 2018), South China Morning Post (SCMP) reported on the story of 27-year-old Australian Andrew Wong, a former JPMorgan Chase trader who quit the largest bank in the U.S. to join Hong Kong-based crypto exchange “International Digital Currency Markets” (IDCM) as its youngest managing partner.

Wong started his career as an intern — working on securitized products (Equities, Structured Exotics and FX) — at Deutsche Bank . He later joined the graduate programme at JPMorgan’s Sydney office, where he worked in various departments. Three years later, he moved to their Hong Kong office, where he was a trader for the next four years; it was during this period that he came across blockchain technology and cryptocurrencies.

The bearish mood of the crypto markets did not diminish his excitement about crypto, and so he decided to get into the game by resigning from JPMorgan and joining IDCM, a digital asset exchange based in Hong Kong, as its youngest managing partner.

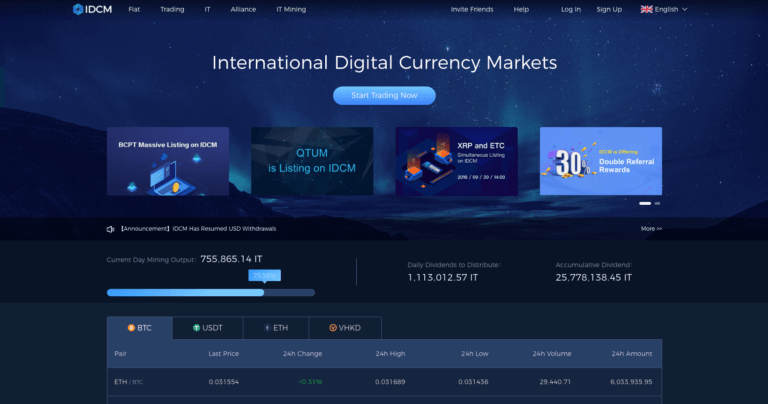

IDCM, which was launched in April 2018, is currently the world’s 15th-largest crypto exchange by adjusted trading volume. The SCMP report says that what makes IDCM interesting is “that it uses centralised and decentralised exchanges, delivering both liquidity and stability, while also providing unique initial coin offerings (or ICOs) for clients.” It also says that IDCM “has a liquidity pool that covers 60 countries, with services that include an IDCM mobile app, a wallet app, research portals and an asset management arm.”

Wong says:

“Blockchain is a form of decentralisation that challenged the status quo in an industry such as banking which is behemoth-like and stagnant… The promise of shaking things up appealed to me…The way I thought about it was akin to horse racing: I could either try to pick a horse and win, or I could take on the model of the Hong Kong Jockey Club and ride a wave which I knew was eminently evident.”

He adds that he is working even harder now than when he was at JPMorgan:

“I’m working harder than ever compared with my time at the bank, but I’m loving every second of it. Why? Because the risk versus reward makes a lot more sense here in this industry. Pulling one deal off in the crypto space was more than I could ever imagine in a financial institution.”

Wong is also excited about crypto’s future potential for disruption:

“I’ve seen a surprising amount of errors in equity trades, which result in human intervention… If you think about it from an opportunity-cost perspective, this drives transaction costs and it increases the time to clear a transaction… The problem is scaled up when you include cross-border transitions… Decentralised ledgers can solve many of the issues.

Imagine a virtual Hong Kong dollar with inbuilt compliance and security protocols… [That means] no more evasion of tax, fewer legal issues and another way to combat money laundering; the possibilities are truly endless.”

Finally, this is his advice for other millenials:

“Getting in quickly with the correct mindset is the right and only way to go. We should be innovative and not be in it just to profit because cryptocurrencies aren’t made for just a quick buck. Now is the right time to be involved in pioneering and developing this asset class.”

Featured Image Courtesy of International Digital Currency Markets