The total crypto market shrank by 1.2%, and overall volume lost 5% over the past 7-days. A few positive regulatory developments have not buoyed the price and it is unclear what is behind the 4% drop at the end of the week. VanEck, SolidX, CBOE met with the SEC commissioner it what appears to be a productive meeting.

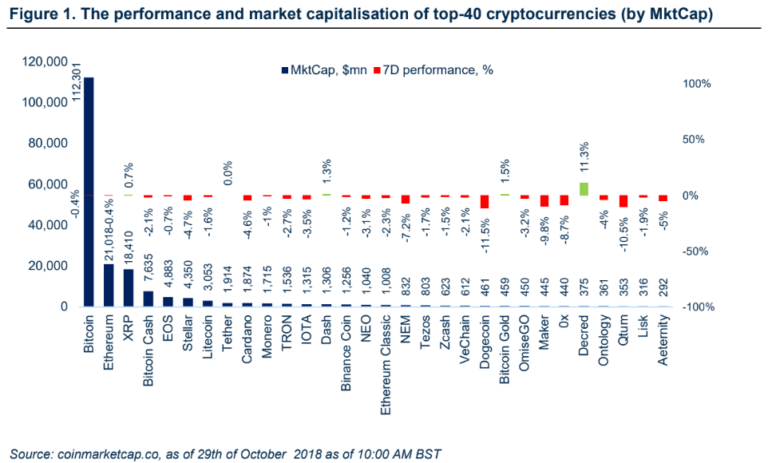

Cryptocurrencies recorded another week in more or less neutral territory. Bitcoin had its lowest volatility since December 2016, however, at the end of the week took a 5% tumble. The best performer among the top-40 crypto is Decred (11.3%), Siacoin (5%) and Zilliqa (4.2%). This week’s worst performers from the top-40 assets were Basic Attention Token (-12%), Dogecoin (-11.5%), and QTUM (-10.5).

Regulatory News

UK Financial Taskforce Publishes Report Listing Opportunities and Risks of Crypto Assets

A United Kingdom crypto-asset taskforce has published a report detailing some of the opportunities and risks distributed ledger technology (DLT) and crypto assets pose, and have indicated they will act to mitigate potential risks in the sector. The taskforce, comprised of HM Treasury, the Financial Conduct Authority (FCA), and the Bank of England, was launched in March by Chancellor of the Exchequer Phillip Hammond. According to the report, there was growing recognition of how DLT “has the potential to deliver substantial benefits,” but “growing evidence” crypto assets harm consumers and markets.

Japan Grants Crypto Exchanges Self-Regulatory Status and Considers Margin Trading Cap

Japanese Financial Service Agency (FSA), has formally approved a Japanese Virtual Currency Exchange Association (JVCEA) as a “certified fund settlement business association,” a status that will let the body set rules for the nation’s exchanges and act over any violations. The JVCEA is composed of 16 exchanges and in order to be a part, a new member must now complete an 83-page Q&A form which includes the exchange’s reserve, offered trading pairs and the maximum leverage ratio. According to a Nikkei news report, the FSA is considering limiting margin traders borrowing power to 2- 4x their deposits. Currently, Japanese crypto traders can leverage up to 25x, meaning that just a 4% drop would wipe out the entire deposit.

VanEck, SolidX, CBOE ETF Meeting with SEC Commissioner

New SEC commissioner Elad Roisman, has met with representatives of SolidX, VanEck and CBOE (ETF applicants) to discuss a rule change proposal which the companies submitted as part of an effort to launch a Bitcoin ETF. ETF representatives have substantiated the possible approval by stating that the previous issues identified by the SEC have been resolved. A memorandum from the meeting can be found here and just for information, the ETF states the share price would be ~$200,000 (25 BTC/share). – The SEC has additionally asked for public comments regarding the ETF and CryptoGlobe sum up the most interesting answers here.

China Requires Blockchain Service Providers to KYC Users

The Cyberspace Administration of China published a regulatory draft, which requires companies and entities operating in China which provide blockchain-based information services, to ask users to register their real names and national identification card numbers in order to fight anonymity. It is however unclear, when the rules will be officially in force.

EU Securities Watchdog Advisor Recommends Regulating Crypto Assets under Existing Rules

The Securities and Markets Stakeholders Group (SMSG), a group which advises the ESMA – the EU’s securities watchdog – has recommended regulating most cryptocurrencies and ICO tokens under existing financial rules, since transferable crypto assets used in payments (such as bitcoin) are increasingly considered as investments, thus the ESMA should consider such assets under the EU’s MiFID II (Markets in Financial Instruments Directive II). “This is, however, not in ESMA’s power, since it would require a change in the Level 1 Text of MiFID II, so the SMSG can only urge ESMA to consult with the European Banking Authority on this matter and take this up with the European Commission”, the report states.

Crypto Markets

Bakkt Bitcoin Futures Could Go Live in December

ICE’s (the owner of New York Stock Exchange) crypto trading platform Bakkt, will officially launch on December 12th, pending regulatory approval. Bakkt could get its approval for trading Bitcoin Futures as soon as next week, according to a source close to them. The Bakkt futures will be physically-settled, meaning traders will receive a payout in Bitcoin, not in cash, which is a main difference compared to CBOE/CME Bitcoin futures. More on Bakkt futures specifics here.

Coinbase Adds Stablecoin and Can Officially Store Crypto

U.S. customers outside the state of New York can now buy, sell, send and receive the USDC token backed by $ at 1:1 ratio. “The underlying technology behind the USDC was developed collaboratively between Coinbase and Circle, in our capacity as partners and co-founders of the new CENTRE Consortium”, the company’s blog stated. It’s important to include the fact that Coinbase is able to freeze and censor the accounts with USDC holdings.

The New York Department of Financial Services has granted Coinbase’s custody application for its assets. Coinbase can now officially store Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin and XRP.

Bitcoin-Backed Ethereum Token on the Rise

Kyber Network, Republic protocol and BitGo, are partnering to create an ERC20 token which will be backed one-for-one by Bitcoin, called Wrapped Bitcoin (WBTC). WBTC is aiming to replicate the utility of Bitcoin in a way that is interoperable with Ethereum. CTO of BitGo, Benedict Chan has explained WBTC’s purpose as it is “very similar in some ways to how people created banknotes that represented a pound of gold. A pound of gold was heavier and it took longer to trade. You could use a note which represented a pound of gold and it was well accepted”. WBTC tokens will feature a full proof-of-reserves verifiable directly on the two blockchains, transfers of WBTC for BTC and vice versa will be completed in the form of atomic swaps (two-way cryptocurrency trades across different blockchain platforms without any risk of one party defaulting on their end of the agreement). Interestingly, with the official launch of the WBTC token in January of next year, a decentralized autonomous organization (DAO) would also be activated and tasked with overseeing the ongoing development of the project.

Agricultural Consortium Eyes Blockchain to Digitize Global Trade

The four biggest agricultural corporations, Archer Daniels Midland Company, Bunge, Cargill, and Louis Dreyfus, announced in a joint press release that they are looking at ways to standardize and digitize international agricultural shipping transactions “for the benefit of the entire industry.” The initial plan is to focus on automatization of grain and oilseed post-trade processes and further to digitize other manual and high-cost paper-based processes. “We expect an industry-wide initiative of this nature to be able to accelerate improvements in data management and business processes, and bring much-needed automation to the industry”, CEO of Bunge, Soren Schroder, stated.

Australian Stablecoin Is Launching on Stellar

Australian online payment processor Novatti Group, will issue AUD Utility Token backed 1-for-1 with AUD held in trust. Managing director of Novatti, Peter Cook, said, “we think that people will use them [stablecoins] to help purchase goods from Australian enterprises. And we think that they will also use them for the payment of bills or for services inside of Australia.”

Crypto exchange Binance has received an undisclosed funding from Vertex Ventures to establish a fiat- to-crypto exchange in Singapore

Crypto derivates trading startup dYdX raised $10 million in Series A led by Polychain Cap and Andreessen Horowitz’s a16z. A Turing Award winner (something like an Oscar in computer science) and MIT professor Silvio Micali, have raised $62 million for his blockchain protocol Algorand. Mining giant Bitmain has been found to have been responsible for advertising the false claims in the pitch deck for IPO investors. Neither Softbank, Tencent, DST Global nor GIC participated in the $400 million Series B round. Another notable crypto mining firm Bitfury, valued between $3-5 billion is considering an IPO in either Amsterdam, Hong Kong or London.

Security Token News

Deutsche Börse and German Central Bank Succesful Blockchain Settlement Trial

Deutsche Bundesbank, Germany’s central bank, and Deutsche Börse, owner of the Frankfurt Stock Exchange, have successfully completed the settlement of securities transactions, payments (including interest) and bond repayments using permissioned blockchain technology (IBM’s Hyperledger Fabric). “The tests have shown that blockchain technology is a suitable basis for applications in the field of settlement and other financial infrastructures,” said Berthold Kracke, CEO of Clearstream Banking and Head of Clearstream Global Operations at Deutsche Börse Group. Singapore Stock Exchange, Central bank of South Africa and Bank of Canada are conducting similar trials.

Tokeny and Blocktrade Align to Build STO Ecosystem

Luxembourg-based tokenization platform Tokeny, has partnered with Blocktrade, which is essentially a regulated crypto exchange, to enable listings of tokens issued on Tokeny. “Listing tokens on a secure and regulated trading platform is of utmost importance to our clients and partnering with Blocktrade.com realizes this vision of tokenized securities trading”, CEO of Tokeny, Luc Falempin explained the purpose of the partnership.

MedTech VC Launches STO Platform for Its Own Token

BlueOcean Ventures II, a tokenized medtech venture capital fund backed by Swiss-based VC firm BlueOcean Ventures, recently announced the launch of SwissVCToken, the security token offering (STO) platform developed for the sale of the fund’s BOV Token. The BOV Token will enable accredited investors to indirectly generate investment returns from the fund’s portfolio startups at their early stage. So far, BlueOcean Ventures II has invested in five medtech startups and is aiming to reach up to 12 companies. The fund is allowing its investors to buy the tokens with both cryptocurrency (BTC and ETH) and