San Francisco-based digital asset exchange, Coinbase, is reportedly expecting a revenue of around $1.3 billion for this year. This, according a document Bloomberg recently reviewed.

As CryptoGlobe reported, Coinbase may seek a valuation of about $8 billion – which would make it the “highest valued” startup in the US.

The US-based exchange also recently added Christopher V. Dodds, a veteran chief financial officer at Charles Schwab, to its board of directors.

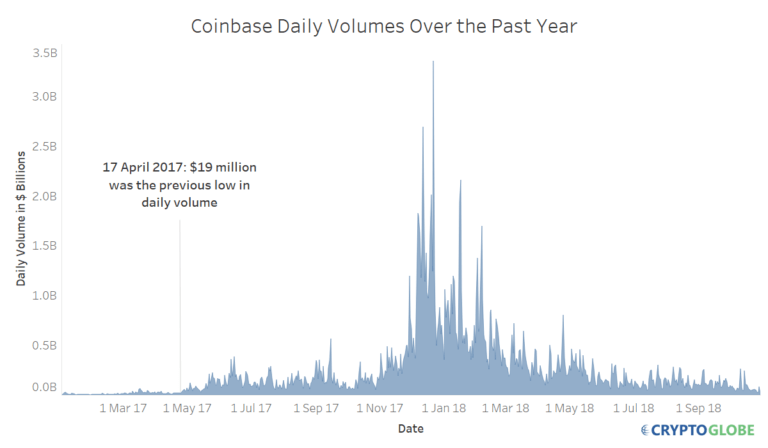

Daily Trading Volumes Peaked In Late 2017, Early 2018

Notably, Coinbase’s recent valuation estimate is at least five times greater than it was last year (in 2017). Despite the extended crypto bear market, the digital currency trading platform still might have been able to generate a sizable revenue this year from the commissions it charges its users.

In December of 2017 and early 2018, daily crypto trading volume on Coinbase was in the billions of dollars, and peaked at around $3.5 billion in January of 2018. These numbers have now dropped considerably, however, it seems that the exchange’s reserves may have helped it remain afloat even though crypto prices have plummeted.

Coinbase is also known to have made substantial investments in various cryptocurrencies, however, there is no accurate estimate available on the current value of its assets.

$456 Million In Projected Profits

In 2016, when the digital currency market was a small fraction of its present size, Coinbase had reported a revenue of only $17 million, while also recording a loss of about $16 million. In 2017, Coinbase earned a massive profit of approximately $380 million – due to the dramatic increase in cryptocurrency prices last year.

This year, however, the leading crypto exchange is expecting to earn even more as it has projected a profit of about $456 million in 2018. Commenting on Coinbase’s business development, Asiff Hirji, the president and chief operating officer at Coinbase, said:

The companies interested in investing in us know that this is the next wave of tech innovation. This was an opportunistic round. We didn’t have to go out and raise capital.

Diversifying Business

Although the number of active users on Coinbase has dropped by about 80 percent since the time period between late 2017 and early 2018, the company has still managed to not only remain operational but has also made some key acquisitions.

In order to further expand its crypto trading services, Coinbase acquired Paradex, a decentralized digital asset exchange (DEX), in May of 2018. Due to the increasing number of hacks of large centralized exchanges, many crypto investors might feel more comfortable trading on a DEX – as traders do not have to share their private keys on these platforms.

While Coinbase expects to earn profits in this year’s bear market, Hirji emphasized that the exchange’s business depends heavily on cryptocurrency prices – meaning that if they decline further, then Coinbase’s sales would also drop.

$503 Million In Company Bank Account

According to the document referenced by Bloomberg, Coinbase had about $503 million in cash in its company bank account. In order to remain competitive, the American firm has launched new products such as the Coinbase Bundle (in late September). As its name implies, Coinbase Bundle allows users to invest in multiple major cryptocurrencies with a single purchase order.

Last week, Coinbase Custody (“an institutional-grade service optimized for storing large amounts of cryptocurrency in a highly secure way”) obtained a license to operate as an independent qualified custodian. As covered, Coinbase raised $300 million during its most recent fundraising round.

While discussing the kind of investors Coinbase is looking for during its latest fundraising round, Hijri said:

For this round, we simply weren’t interested in taking investments from firms that didn’t have a constructive view of crypto. This round, and the future of crypto in general, needs to be about more than asset prices.