Leading cryptocurrency exchange Bitfinex has “temporarily paused” or suspended fiat deposits in USD, Euros, British pounds (GBP), and Japanese yen (JPY). However, screenshots shared by people who trade on the British Virgin Islands-registered exchange appeared to indicate that “things are expected to resume in a week” or “normalize” within that time frame.

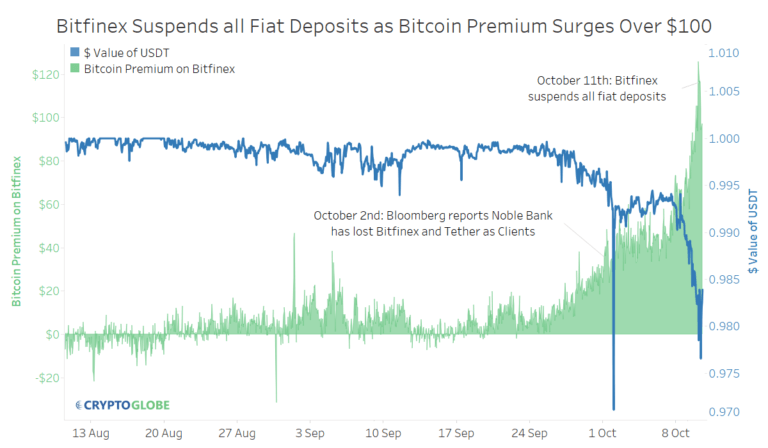

These latest banking problems have been reflected in the market’s attitude to the exchange in the last few days. Looking at the title chart the bitcoin USD ‘risk premium’ on Bitfinex has increased to over $100 over other exchanges – market analysts believe this reflects the higher risk of trading on Bitfinex.

CryptoGlobe reached out to Bitfinex to learn more about the situation. The exchange replied:

Bitfinex has temporarily paused the depositing of fiat to customer accounts. We expect full trading capabilities to resume as normal within a week. All other service and business features on the platform remain unaffected and are operating as normal.

Banking Problems

Last week, reports had surfaced that Bitfinex, which operates from Hong Kong, may have been holding a large amount of its funds at Puerto Rico-based Noble bank – now looking for buyers as it is no longer profitable.

Noble bank is reportedly struggling to continue its operations because Bitfinex and Tether (USDT), its former customers, have parted ways with the financial institution. According to TheBlock’s research, Bitfinex had opened its accounts at HSBC, one of the world’s largest financial services organizations.

TheBlock’s researchers revealed that Bitfinex’s private account had been created under the name, Global Trading Solutions. Notably, HSBC might not have known that the account actually belonged to Bitfinex as it was opened under a different name.

Per the crypto analysis website, it “appears that [Bitfinex’s] private account” with HSBC “is no longer functional” and the exchange may not currently have “an active method of deposits as all USD, EUR, JPY and GBP deposits” have been suspended.

As CryptoGlobe reported, the cryptocurrency market experienced a massive selloff on Thursday during which Bitcoin (BTC) dropped over 5% within 30 minutes. The prices of other major digital currencies including Ethereum (ETH), Ripple (XRP), and Bitcoin (BCH) also dropped significantly.

Many market watchers are now wondering whether there might be some connection between the sharp decline in cryptocurrency prices and possible issues related to Bitfinex’s recent operations.

As CryptoGlobe covered, Bitfinex had responded to allegations (on October 7th) that it was either becoming, or was now, insolvent. Medium blogger ProofOfResearch had noted that his investigation of the exchange’s operations indicate that “Bitfinex is no longer solvent.”

Bloomberg also reported:

Noble Bank attracted attention in cryptocurrency circles earlier this year because of its willingness to work with Tether and Bitfinex, which was dumped last year by Wells Fargo & Co.

Meanwhile, many other market analysts suggested that there may be links to Tether’s recent issues, however, Bitfinex dismissed these allegations by stating people have “little understanding of what [insolvent] means and what they are generally talking about.”