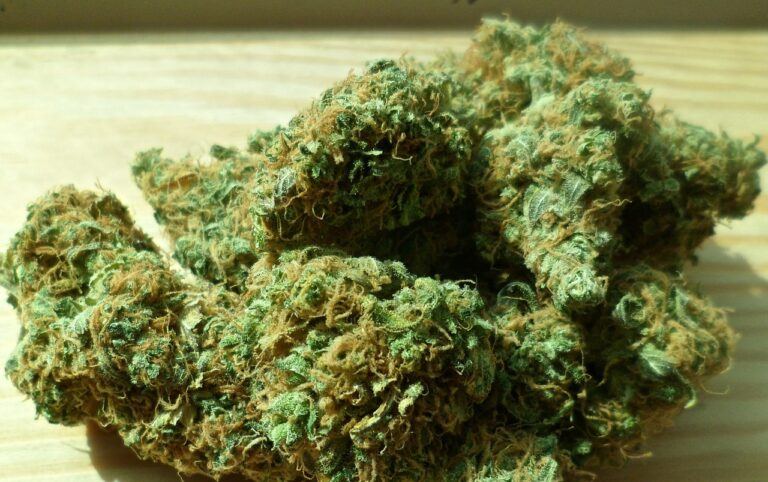

Billionaire Michael Novogratz, who has reportedly invested 10% of his fortune into digital assets, told CNBC’s Fast Money (on September 20th) that there are many similarities between the current craze with cannabis (marijuana) and when cryptocurrencies hit record level highs toward the end of 2017.

The former Goldman Sachs partner said (during the Yahoo Finance All Markets Summit): “The prices of cannabis stocks today feel like bitcoin and ethereum did in December of last year.”

Commenting on how the price of Tilray stock (ticker: TLRY) recently surged 50 percent, Novogratz claims he discovered a “cool way” to short it after “trying really hard.” He explained his trading strategy as follows:

The [pot] companies trade up to $28 billion on almost no revenue. If I was long them, I'd sell them and if you're a speculator, I'd get short them.

Shorting Crypto

Novogratz, who is known for being a strong Bitcoin (BTC) supporter, noted that the flagship cryptocurrency’s price increased in a manner that is similar to how cannabis stock prices have been surging. However, the Bitcoin price has fallen nearly 70% since then, and is trading at $6,661.70 at press time according to CryptoCompare data.

The decline in cryptocurrency prices, particularly Ethereum’s native token Ether (ETH), may be partly due to the introduction of various trading options that allow traders to easily short Ether. For instance, crypto derivatives trading platform, BitMEX, has introduced a new swap product that has made it a lot easier to short ETH – which many believe might have played a big role in the token’s drop below the $300 and $200 levels.

Despite various other more serious issues such as frequent hacks, regulatory pressure, and numerous scams associated with cryptocurrencies, which analysts frequently cite for their declining prices, Novogratz thinks that the digital asset market will recover.

Institutional Money Coming Soon

While speaking at Yahoo Finance’s All Markets conference, the former partner at Fortress Investment Group (a New York-based firm generating over $1 billion in annual revenue) said the crypto industry is now at a point where institutional investors are about to enter its volatile markets.

As founder of crypto merchant bank Galaxy Digital, which reported a $134 million loss in Q1 2018, Novogratz has predicted that the crypto market will begin to surge within the “next two to three months.”

He explained that institutional investors had been hesitant to invest in digital currencies because they had cited concerns about there not being proper custodian services for them; or tools and technology that would allow them to safely and securely hold (or store) their digital assets.

However, Novogratz believes consumers will likely be a lot more confident when they see more Wall Street firms enter the crypto space as they will help develop better custodial solutions for digital currencies. He added that they may even acquire some of the crypto-related custody firms such as Xapo.

“Institutional FOMO”

The rapidly evolving cryptocurrency market will lead to a paradigm shift in how the world’s financial industry operates, Novogratz predicted:

The banks are going to experience institutional FOMO just like retail experienced it. We’re seeing it as we sit here. And they’re doing a ton of work because this is real. This is not tulips. We will have an internet 3.0. There will be a decentralized set of global supercomputers.

The Princeton University graduate also said the crypto market was beginning to mature as Bitcoin, the flagship cryptocurrency, had now “established itself as the first digital asset” that can serve as a legitimate store of value, given the various cited reasons for strong support levels for its price at $6,000.