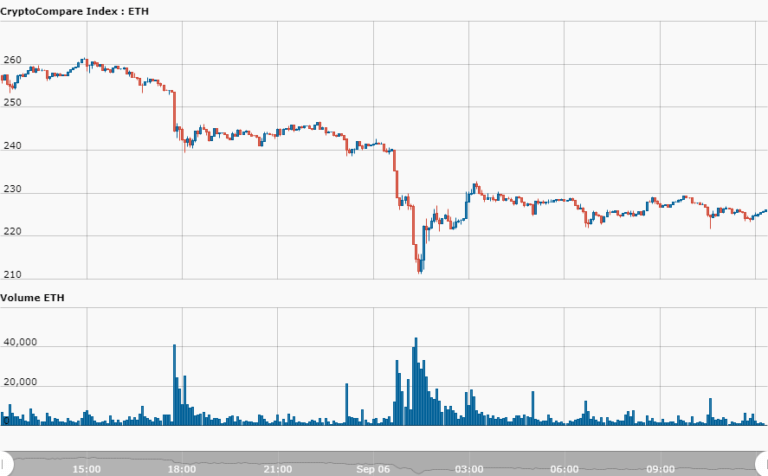

Ether (ETH), the second largest cryptocurrency with a market capitalization of over $23 billion, has dropped to its lowest price since September 15th, 2017. The Ethereum blockchain’s native token is currently trading at $226.67 according to data from CryptoCompare.

At 16:00 UTC, the Ether price had fallen sharply to around $211. This is the lowest price for ETH since July 30th, 2017. As CryptoGlobe reported on August 13th, Ether dropped below the $300 mark for the first time in 2018, while reaching levels last seen in November of 2017.

Crypto Market Crashes As Goldman Sachs Shelves Plans For Trading Desk

In the past 24 hours, the ETH price has declined by nearly 20% – making it one of biggest losers out of all the major cryptocurrencies. Moreover, Ether has now lost all the gains it experienced during the historic crypto market bull run from last year. After trading at an all-time high of around $1,357, ETH is now down by over 84%.

As covered on CryptoGlobe, Bitcoin (BTC), the flagship cryptocurrency, also dropped below $6,900 after a mysterious whale (linked to the now-defunct Silk Road black market) shifted 111,000 BTC and Bitcoin Cash (BCH) to multiple different wallets.

The bitcoin price then plunged for a second time in the past 24 hours, and is now trading at $6,397.93 at press time. The sharp decline in cryptocurrency prices, including Cardano (ADA) which has dropped over 15% in the last 24 hours, is being attributed to Goldman Sachs’ decision to not move forward with its plans to launch a crypto trading desk.

Cryptos Will “Not Retain Value”

The large investment bank may, however, introduce a digital currency trading platform at some later point. Sources working closely with Goldman Sachs revealed that the institution may have shelved its plans for now due to regulatory uncertainty around cryptocurrencies.

As crypto prices crash, it’s worth noting that Goldman Sachs released an extensive report in early August stating that cryptocurrencies will “not retain value” because they cannot function effectively as money. The report also said cryptos did not deserve all the attention and media coverage they have received.