On Wednesday (12 September 2018), U.S. based digital asset exchange Bittrex announced that it was planning to launch two new USD trading pairs.

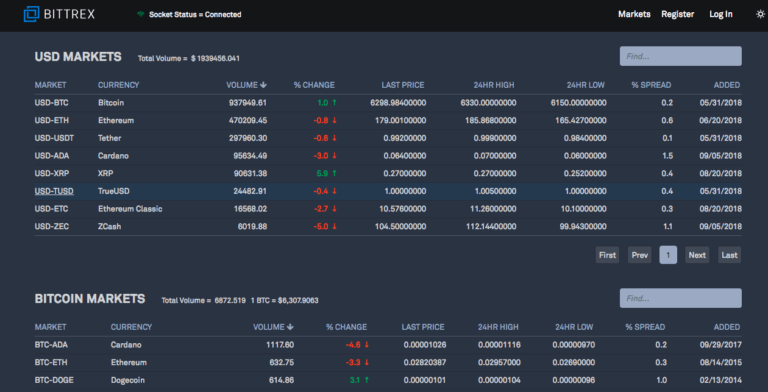

It all started on 31 May 2018 when Bittrex said that it was offering US dollar (fiat) trading for corporate customers and planning “to expand these services over time to include all qualified customers.” The initial markets for fiat trading on Bittrex would include Bitcoin (BTC), Tether (USDT) and TrueUSD (TUSD). Bittrex said that it was “implementing a phased roll out to help establish quality control for the new markets and ensure customers have the highest level of service possible.”

At that time, Bittrex CEO, Bill Shihara, stated:

“As an incubator and leading advocate of blockchain technology, Bittrex is committed to listing tokens that not only have the best business applications, but also are the most innovative blockchain projects in the world. Expanding fiat markets to the top digital currencies on our exchange should further drive adoption of this revolutionary technology by providing customers even more options for purchasing and trading digital currencies in a secure, robust and reliable environment with high liquidity.”

Then, on 14 June 2018, Bittrex said that it was time to roll out the next phase by “starting to invite small groups of retail customers to participate in the USD markets.”

On 20 June 2018, it added Ethereum (ETH) to USD (fiat) markets. And on 8 August 2018, Bittrex announced that on 20 August 2018, it would be launching USD markets for XRP and Ethereum Classic (ETC).

On 29 August 2018, the exchange announced that it was going to launch USD markets for Cardano (ADA) and Zcash (ZEC) on 5 September 2018.

And today, Bittrex made many TRON (TRX) Litecoin (LTC) fans happy with the following announcement:

We’re rolling out more USD pairs. On Sep 17 we’re launching US dollar (USD) markets for TRON (TRX) and Litecoin (LTC). Eligible #Bittrex accounts created before Sep 4 are already enabled for USD trading. New user or want to deposit/withdraw USD? Details: https://t.co/KA248OA2Bz pic.twitter.com/21xA8xZ4vm

— Bittrex (@BittrexExchange) September 12, 2018

As Bittrex has said before, it is going to continue adding tokens/coins to its USD markets. With the addition of these two new USD trading pairs, from 17 September 2018, those customers invited to participate in the rollout will have access to USD markets for BTC, ETH, USDT, TUSD, XRP, ETC, ADA, ZEC, TRX, and LTC.

As for who is eligible to apply for USD trading, this is what Bittrex has said in the past:

“Current Bittrex corporate and personal account customers, who reside in eligible states and qualified international regions, are able to apply for USD trading at this time. Corporate customers may apply for USD trading by completing this request form, and personal account customers may apply by completing the following form. For current customers living outside the initially approved locations, please note more states will be added over time. With each new phase, we’ll continue to provide you updates and information about how to apply for fiat trading.” Currently, the eligible U.S. states are Washington State, California, New York and Montana.

This move by Bittrex is significant because it increases TRX and LTC liquidity. Currently (as of 19:00 UTC on September 12th), according to data from CryptoCompare, TRX is trading at $0.01792, down 2.29% (in the past 24-hour period), and LTC is trading at $51.68, up 0.9% (in the past 24-hour period).

Featured Image Credit: Image Courtesy of Bittrex