Coinbase, the USA’s largest cryptocurrency exchange has announced a new assets listing framework that will greatly increase the number of listed assets and make listings more frequent than they currently are,

Announcing the changes in a statement on its official blog, Coinbase says that the new listing process will ensure that its customers have access to digital assets that meet its standards alongside tools to help them discover, evaluate, trade and use cryptocurrencies.

New Asset Listings and Segmented Access

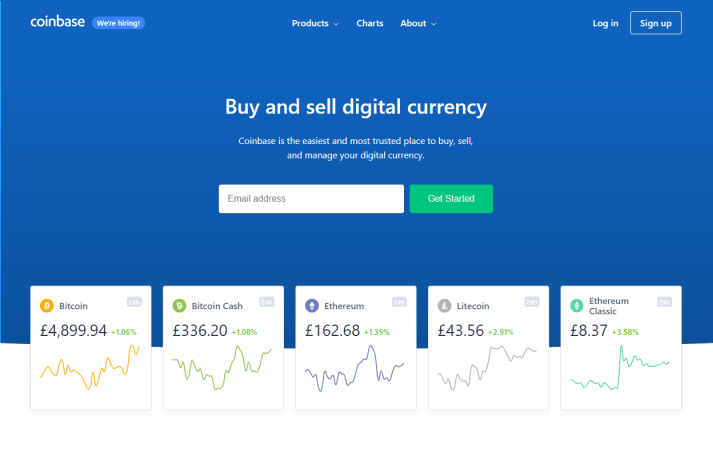

According to the statement, Coinbase is making the changes in response to widespread user demand asking the platform to explore the thousands of existing digital assets outside of bitcoin, bitcoin cash, ethereum, ethereum classic and litecoin which it currently lists. One of the most consistent user requests, Coinbase says, is that they should be given access to these assets.

The new process is designed to create a framework for rapidly listing digital assets that are in compliance with the local law in users’ jurisdictions by granting listing requests on a per-location basis. This means of course that users in different jurisdictions using the same Coinbase platform may not have access to the same assets, at least until such a time as all regulatory interplay is concluded.

Under the revamped process, issuers applying for assets to be listed will be required to fill a form that will be used to evaluate the asset against the constantly updated Coinbase Digital Asset Framework. This process will not initially attract an application fee, though Coinbase says it may impose one in future to defray legal and operational costs depending on the volume of submissions. Some assets may also be listed even without an application at the platform’s discretion and in all cases, quick and specific feedback will be given to explain approval or rejection of assets.

Change in Announcement Time Frames

According to the announcement, Coinbase expects to list most assets that meet its standards over time, but due to the increased frequency of listing announcements when this happens, they will only take place at or near the time of public launch on a Coinbase platform.

Though this is a departure from its recently-instituted advance notification policy introduced in the wake of last year’s Bitcoin Cash listing fiasco that led to accusations of Coinbase insider trading, the platform says that announcements will still take place early enough to permit provision of sufficient liquidity and an “orderly market bootup process”.

Coinbase employees are also subject as before to trading restrictions and confidentiality arrangements so as to prevent a recurrence of the situation that led to a class action lawsuit filed against Coinbase on behalf of bitcoin cash investors earlier this year.

The company then commits to providing a greater wealth of educational resources and tools on its platform to help users enlighten themselves about digital assets and make informed trading and investment decisions.

The statement concludes:

We think of Coinbase as the global bridge from fiat to crypto, from the fragmented financial system of today to the open financial system of the future. We believe this new listing process allows us to quickly add assets while remaining compliant with local law and continuing to offer our customers the safe, high-quality experience they have come to expect from Coinbase.

Community Response

The announcement prompted some interesting responses on Twitter with prominent figures speculating about the possible motivations for the move:

Pretty sure that applications that go through this form go directly in the trash bin. It's just an attempt at stopping the harassment by certain communities. We've seen these type of application forms since the first crypto exchanges and they never worked. https://t.co/YZNZ1FhJjp

— WhalePanda (@WhalePanda) September 26, 2018

do consumers feel like there's a real bottle neck in their ability to buy cryptocurrencies and tokens? i imagine @coinbase monthly active users (MAUs) are down 75-90% following bull run, so maybe this is an attempt to drive engagement and metrics?

— Meltem Demirors (@Melt_Dem) September 25, 2018