On Wednesday (8 August 2018), the Switzerland-based crypto exchange ShapeShift announced that it had acquired Texas-based startup Bitfract, which has developed a tool that lets you trade a Bitcoin for multiple altcoins in one simple transaction in order to make it safer/easier “for average users to gain exposure to diversified digital asset portfolios.”

Here is how Bitfract works:

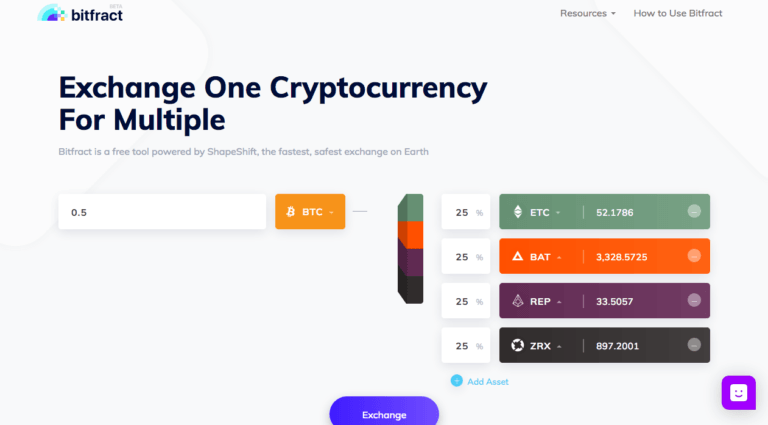

- As you can see in the screenshot above, you need to select your input asset (currently, Bitcoin, but Ether and Litecoin shupport should be coming soon) and the amount that you want to “convert” into some altcoins (both coins and tokens). Next, you select your output cryptocurrencies (from a list of around 64 altcoins, a few which, such a STEEM, are temporarily unavailable) and for each of these “outputs”, you need to specify the percentage of your input Bitcoin holding that you wish to convert into that cryptocurrency. When you are finished with your portfolio allocation, you click on the “Exchange” button to go to the next step.

- You need to specify your wallet address for each of the altcoins you chose to convert to in step 1. Then, you click on a “Confirm button” to go to step 3.

- Bitfract shows you a QR code representing its Bitcoin deposit address. You then need to send the amount of Bitcoin you specified in step 1 from your Bitcoin wallet to the Bitcoin deposit address shown to you. As soon as your bitcoins have been received and confirmed, Bitfract starts the exchange (using the ShapeShift APIs).

Erik Voorhees, the founder and CEO of ShapeShift, explained why his company had decided to acquire Bitfract:

“The Bitfract team made expert use of ShapeShift’s open API to build a product that we ourselves were planning to build. This demonstrated a great alignment of strategy and thinking, and their execution was so exceptional that we wanted to bring their talented team and technology on board.”

Willy Ogorzaly, a co-founder and CEO of Bitfract, explained why he was so happy about his company being acquired by ShapeShift:

“Out of all of the companies and exchanges in crypto, ShapeShift has always aligned most closely with our mission and values. When Erik asked if we wanted to join ShapeShift, the answer was immediately yes. We believe in a decentralized future where individuals freely control their digital wealth, and our team is honored to work alongside Erik and everyone at ShapeShift to make this a reality.”

Shapeshift says that, following the completion of the acquisition, “the Bitfract tool will be maintained and continue to operate as a demonstration of the power of ShapeShift’s open API” and the Bitfract engine will be “incorporated into ShapeShift’s core platform in the near future.”

Featured Image Credit: Image Courtesy of Bitfract