On Thursday (2 August 2018), Boerse Stuttgart, Germany’s second-largest stock exchange, announced a massive increase to its existing support for the crypto space.

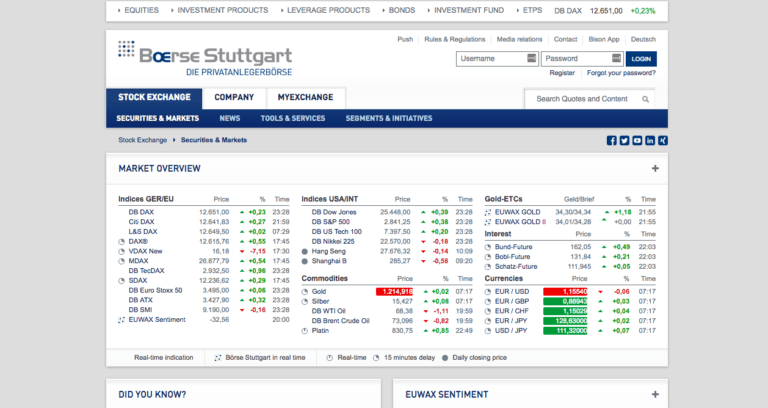

The first time we officially heard about Boerse Stuttgart’s interest in this space was on 13 April 2018. Back then, Boerse Stuttgart Digital Ventures (a subisidary of Boerse Stuttgart) announced that one of its subsidiaries, Sowa Labs, was working on a commission-free cryptocurrency trading app called BISON that would be released this autumn. The managing director of Sowa Labs explained what was significant about BISON: “It is the first crypto app in the world to have a traditional stock exchange behind it.” The BISON website says that the initial version of the app supports Bitcoin (BTC), Ether (ETH), Litecoin (LTC), and XRP, with “more assets to come in the near future.” The following screenshot should give you a rough idea of what the BISON app will look like:

Now, Boerse Stuttgart Group says that it has much more ambitious plans than was originally thought:

“Boerse Stuttgart Group is creating an end-to-end infrastructure for digital assets. After the start of cryptocurrency trading via BISON, there will soon be a platform

for initial coin offerings (ICOs), a multilateral trading venue

for cryptocurrencies as well as solutions for safe custody.Boerse Stuttgart Group thus continues to pursue its digitisation strategy and is becoming a pioneer for the digital transformation of financial markets and financial products.”

On the basis of Boerse Stuttgart’s “extensive know-how in the fields of technology, regulation and trading models,” Alexander Höptner, the CEO at Boerse Stuttgart, explained how the German exchange could make an impact:

“…we can offer central services along the value chain for digital assets, all under one roof. Investors and market participants know that Boerse Stuttgart Group stands for quality, transparency and reliability. As a Germany-based provider we want to transpose this standard into the digital world. We will help to promote acceptance of digital assets.”

The company has a three-pronged strategy:

- An ICO platform that “will allow the issuance of digital tokens, for corporate financing or to represent rights and assets, for instance”; this will “also make it possible to carry out ICOs with standardised and transparent processes.”

- A “multilateral and regulated trading venue for cryptocurrencies” that will allow second market trading of token issued via the ICO platform as well as trading of established cryptocurrencies such as Bitcoin and Ether.

- Solutions for safe custody of cryptocurrencies: “services will include differentiated safety concepts for digital assets and will already be available for the start of BISON.” However, later on, “it will be possible to use the custody service along the entire value chain.”

Boerse Stuttgart’s serious involvement with the crypto markets should only help to ramp up institutional adoption of crypto in Europe, and seems just as significant as Intercontinental Exchange’s Backkt project (which has similar aims for the U.S. market).

Featured Image Courtesy of Boerse Stuttgart