Ethereum Price Medium-term Trend: Bearish

Supply zones: $400, $450, $500

Demand zones: $150, $100, $50

ETH is in a bearish trend in the medium-term outlook. The bearish pressure became weak at $256.02 in the demand area after the formation of a bearish spinning top. The next candle was a bullish spinning top, a further confirmation of the bulls’ return. The bullish engulfing candle pushed the cryptocurrency up to $280.99 in the supply area.

The bulls sustained the momentum with a bullish opening 4-hour candle at $278.39. The price was pushed further up to $291.34 in the supply area. This is within the 50.0 and 61.8 fib level. These are trend reversal zones.

A correction may occur at 50.0 or 61.8 fib level.

Traders should watch as the market play out within the fib levels as the overall outlook is bearish with $160.00 in the demand area as the bears’ next target.

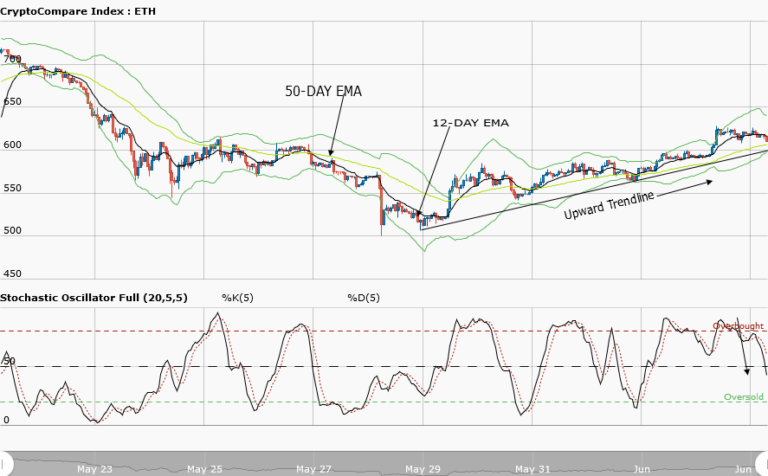

Ethereum Price Short-term Trend: Bearish

ETH continues in the bearish trend in the short-term outlook.

The opening 1-hour candle was bullish at $279.39 and with bullish momentum increased, the cryptocurrency went up to $291.34 in the supply area.

Exhaustion of the bullish momentum is seen with wicks in the candles at $286.00 which implies the bears’ gradual return, coupled with the bearish engulfing candle formed at this point. Moreover, the arc or cup formation suggests that a downward journey in price may occur in the short-term.

The stochastic oscillator is in the overbought region at 76 % and its signal points down which implies downward movement in the price of the cryptocurrency.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.