Facebook’s recent decision to remove Alex Jones’ Infowars from their platform has shone a light on the disproportionate control wielded by centralized tech giants. Calls for applications which run on a shared ‘world computer’ that is trustless and available for everyone to access are growing louder. Yet these decentralized applications are hampered by the low throughput of their underlying base protocols as they seek to chart a course to mass adoption.

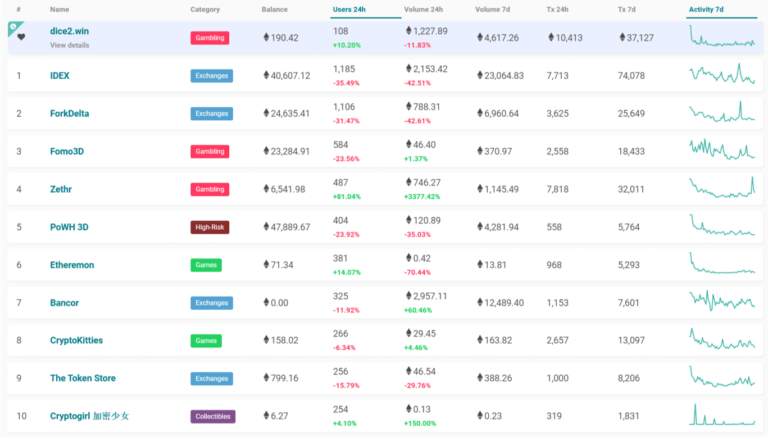

While most dApps use the base protocol token (most likely Ethereum) as a means of exchange, 6 of the top 30 leading decentralized applications come built with their own native, publicly-traded token. Value accrues to these utility tokens as the network usage of the dApp grows. However, since decentralized applications are still in their infancy in terms of usage rate, the trading valuation of these dApp tokens is currently unpegged from their underlying fundamentals and driven largely by speculation. Despite their meager usage numbers, dApp coins have been hugely popular with speculators looking for an early seat on the dApp train.

Augur

Of the 6 dApp tokens, 5 of these projects are decentralized exchanges with the only exception being Augur. Billed as a ‘decentralized oracle and prediction market protocol’, Augur imagines use-cases for prediction markets beyond simple gambling. For example, a Nigerian farmer relying on seasonal rainfall could place a bet against the outcome of rain in his country. Should the rain arrive, his livelihood is secure. Should it not arrive, he will have hedged his losses with his win on the Augur market. While extremely promising in theory, in practice Augur is hamstrung by the slow transaction capacity on the Ethereum blockchain. Indeed, since launching a month ago Augur has never had more than 300 daily active users on its platform.

Augur founder Joey Krug likened his project’s current scaling predicament to streaming HD videos in 1995. Just as internet capacity and GPU speed needed to show significant improvement to support HD streaming, so too the base layer protocols on which dApps are built must overcome their scalability hurdles in order for the decentralized vision of Web3.0 to manifest.

Ethereum Competitors

Many Ethereum competitors have sprung up hoping to provide a high-throughput alternative for dApp builders. Cardano, NEO, EOS and Qtum are amongst the smart contract platforms looking to solve for scalability.

However, the recent controversy surrounding EOS and their consensus model, which gives disproportionate power to 21 block producers, highlights the dangers of sacrificing decentralization in an effort to scale. Not to be outdone by their competitors, Ethereum developers are working on a number of proposed upgrades that promise to increase network capacity. Casper will replace the energy-intensive process of mining with a more scalable Proof of Stake system while Sharding refers to efforts to partition the Ethereum blockchain into many sub-chains, reducing the load on block producers by giving them only a subset of total transactions to verify.

By compounding scalability improvements on top of each other, Ethereum’s founder Vitalik Buterin has set out to increase network capacity from 15 to 1 million transactions per second.

While many internet users are growing increasingly wary of the immense power possessed by Google, Facebook and other tech giants, decentralized applications are not ready to take over just yet as the infrastructure upon which they are developed is still in beta.

With very few daily users, those dApps with publicly listed coins are trading at exorbitant valuations in comparison to their usage rate. However, the influx of speculative capital serves to attract talented developers to solve the scalability problems facing distributed systems. Once the base layer throughput is improved, it could open the door for the mainstream adoption of decentralized applications.