In a recent interview with Finance Magnates published on 27 August 2018, Anthony Barker, the chief technology officer (CTO) of Stellar (XLM) powered Paris-based international money transfer firm Tempo, explained the advantages of using the Stellar network for cross-border payments, and said that crypto is “sort of like a Swiss bank account for every person.”

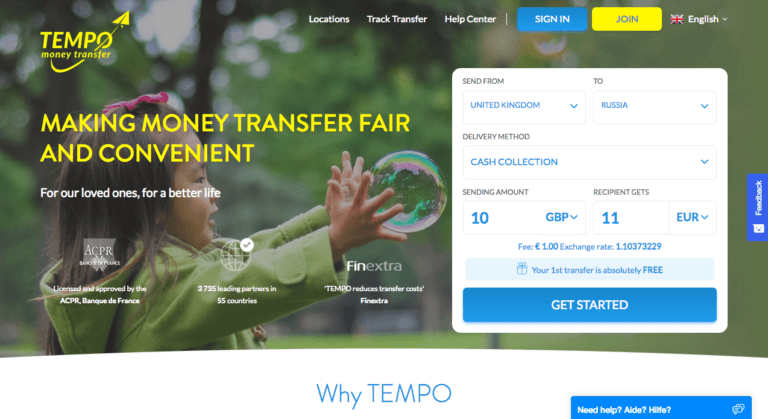

Tempo Money Transfer (or “Tempo” for short) is an EU-licensed, electronic payment services provider, headquartered in Paris, France. It was founded in 2014 by Jeffrey M Phaneuf (currently, the President), Suren Hayriyan, and Anthony Barker (currently, the CTO).

In order to reduce costs, increase speed and reliability, Tempo partnered with the Stellar Development Foundation. Stellar is a platform that connects banks, payments systems, and people. The Stellar protocol is supported by the non-profit organization Stellar Development Foundation. Currently, Tempo is the main EU anchor connecting with Stellar to many other payout payers.

Barker started by talking about the focus of his company:

“[Tempo’s] original focus was remittance and international payments, and it’s since sort of switched to small value payments, the stuff that banks don’t handle well.”

He then explained because traditional solutions to cross-border payments were slow, expensive, and unreliable, Tempo decide to use blockchain technology. Tempo looked at both Stellar and Ripple, and decided that Stellar was “sort of a natural fit.” One of the main reasons for choosing Stellar was because of its non-profit and open-source status:

“My gut reaction was that [Ripple] is not so good for community building… [It’s] much more like a Visa/Mastercard.

“I have a strong belief that open systems win in the long run. For example, Stellar has a development challenge [where] they basically give a lot of Lumens away to software developers who are making open-source projects.”

He went to explain how Stellar’s flexibility had helped them:

“We worked with Jed McCaleb [Stellar.org co-founder and CTO] and his developers, and we added compliance, so it’s integrated into Stellar as a standard 2nd-layer protocol… so we know how to send first name, last name, and date of birth across… They added that really quickly simply because they’re really focused on this global remittance use case.”

At this point is worth saying a few words about Jed McCaleb: prior to co-founding the Stellar Development Foundation with Joyce Kim and working with her to develop the Stellar protocol, he co-founded (with Chris Larsen) Ripple and served as its CTO until 2013. He is also known for creating the ill-fated Bitcoin exchange Mt. Gox.

Barker also talked about why it was important to integrate blockchain technology in such a seamless way that customers do not even realize that behind the scenes a blockchain is handling their payments:

“Our clients are traditional remittance people. They come in with cash and they send their money–they don’t even know in a lot of cases that there’s blockchain behind it, so it’s sort of seamless for the users…

[Tempo] looks more like an Asimo or a WorldRemit–much close to that than if you’re using Coinbase or something else, because you don’t have to know about private/public keys; you don’t have to know about losing your keys or any of these things that drive people crazy…all these things that are kind of hard for users are kind of hidden in our service.”

Finally, although Barker does not think that crypto will completely replace fiat any time soon, he believes that crypto will play an important role in the future:

“I think [crypto] will pay an important role in the future of the global financial sphere… If you live in a country with inflation, or in a country [where the government] wants to steal your money, it’s sort of like a Swiss bank account for every person.”

Featured Image Courtesy of Tempo