On Friday (17 August 2018), UK-based cryptocurrency derivatives exchange Crypto Facilities Ltd announced that it is launching a Bitcoin Cash (BCH) futures contract.

The exchange, which is regulated by UK’s Financial Conduct Authority (FCA), is planning to launch the new product on its platform at 15:00 (UTC).

Reportedly, this product was added because BCH is a top 5 cryptocurrency (currently fourth-largest by market cap), and Crypto Facilities is confident that it will be just as successful as its exisiting futures products with crypto traders/investors for maximizing profits and/or for managing risk exposures.

The firm was founded by Dr. Timo Schlaefer, a former executive director (Vice President of Qunatitative Modelling) at Goldman Sachs, and Jean-Christophe Laruelle, a Software Architect at BNP Paribas and Societe Generale. It was launched on 26 February 2015, and since then has seen an ever-increasing demand for crypto derivatives.

Initially, it offered just one product: a forward contract on the Bitcoin (BTC) price with three expiry dates. It later added futures contract for XRP (10 October 2016), Ether (11 May 2018), and Litecoin (20 June 2018).

Two years ago, in a Reddit Q&A (subreddit “BitcoinMarkets), Dr. Schlaefer, who is the CEO of Crypto Facilities talked about the useful of crypto derivatives:

“If you just want to invest in bitcoin, i.e. buy and hold, you won’t need derivatives. They are very useful however for frequent trading as fees are typically much lower than in regular spot trading. With futures you can also go short, i.e. profit from price declines. This also allows you to get rid of bitcoin risk that you may not actually want without selling your bitcoins. For instance, a bitcoin payment processor may need to hold a certain amount of bitcoins to run the business but may not want to have exposure to bitcoin. In this scenario, shorting a bitcoin Futures will remove this risk without selling the bitcoins.”

“Futures also provide interesting trading and arbitrage opportunities. Typically, they trade somewhat away from the bitcoin “spot” price, and this price differential can be locked in to make a low-risk profit. There is also the opportunity to trade the differential between different Futures on the same platform or across different platforms, or between Futures and the spot price.”

Crypto Facilities also offers cryptocurrency indices and reference rates to financial institutions, trading firms and data vendors worldwide:

On 14 May 2018, CME Group and Crypto Facilities launched the CME CF Ether-Dollar Reference Rate (Ether Reference Rate), which provides a daily benchmark price in U.S. dollars at 4 pm London time, and CME CF Ether-Dollar Real Time Index (Ether Real Time Index), which allows users access to a real-time Ether price in U.S. dollars.” The Ether Reference Rate and Ether Real Time Index are calculated by Crypto Facilities and are based on transactions and order book activity from Kraken and Bitstamp.

At press time, according to data from CryptoCompare, BCH is trading at $547.12 up 3.69% in the past 24-hour period.

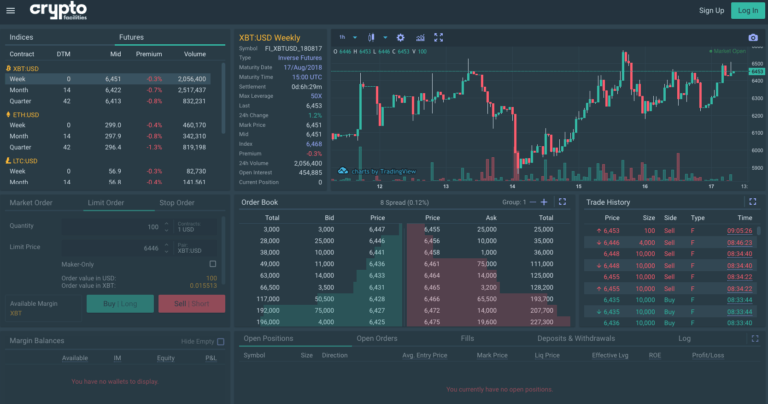

Featured Image Credit: Interface Image Courtesy of Crypto Facilities