On Monday (6 August 2018), Californian FinTech startup Robinhood, announced, via its blog and Twitter account, that its “Robinhood Crypto” platform now offered trading support for a sixth cryptocurrency: Ethereum Classic (ETC). This is the tweet the company sent out to announce the news:

You can now invest in Ethereum Classic on Robinhood Crypto, commission-free. https://t.co/PAidMUpbYq

— Robinhood (@RobinhoodApp) August 6, 2018

This move comes exactly three weeks after the company announced support for Dogecoin (DOGE), and it means that you can now invest in Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, and Ethereum Classic, as well as track market data for 10 other cryptocurrencies.

Robinhood Crypto is currently available in 19 states, but Robinhood seems to be rapidly accumulating the state licenses it needs to offer the service in the remaining states.

On 11 June 2018, Coinbase announced that it was working on adding support for Ethereum Classic. At the time, it said that the work would take a few months. Then, on 3 August 2018, Coinbase said that final testing would be completed by Tuesday, August 7, at which point it would announce its readiness to “accept inbound transfers of ETC”. No doubt, Robinhood, which is a strong competitor to Coinbase in the U.S. market, must have decided step up its development effort for adding ETC so that it could have its support ready before Coinbase.

During the past two months, Ethereum Classic has been one of the best performing cryptocurrencies:

According to CryptoCompare, on 10 June 2018, ETC closed around $12.56, and at press time, it is trading around $17.48, up 6.45% in the past 24-hour period. Between June 10th and August 6th, it has gone up over 39%. And today’s news by Robinhood is likely to add to ETC’s strong momentum.

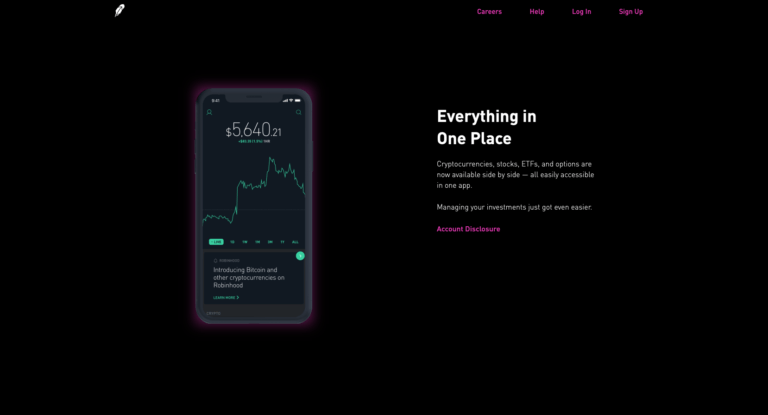

Featured Image Credit: Courtesy of Robinhood