Coinbase, one of the leading cryptocurrency exchanges in the world, was reportedly adding 50,000 users a day last year, when most cryptocurrencies surged to their all-time highs. Per its CEO Brian Armstrong, the company’s growth is accompanying that of the flagship cryptocurrency.

Speaking at the Bloomberg Players Technology Summit in San Francisco, Armstrong revealed the exchange was adding about 500 users a day when it started. After enduring its first crypto bubble, it was adding 5,000, and ended up adding 50,000 per day last year.

While Armstrong didn’t reveal how many users the company is currently adding a day, he noted bitcoin’s price has gone through a series of bubbles, each one reaching a new plateau. While people’s expectations quickly hit “irrational exuberance,” he said, the technology is still developing.

People’s expectations are all over the map, but real-world adoption has been going up.

As for adding new users, Armstrong believes owning a piece of the technology – some bitcoin – will help people learn about it and understand it. The CEO further revealed his cryptocurrency exchange has helped users trade $150 billion worth of crypto last year, and that it now has about 1,000 employees.

During his interview, Armstrong was asked whether Berkshire Hathaway CEO Warren Buffett and JP Morgan CEO Jamie Dimon were wrong about bitcoin. Buffett, as CryptoGlobe covered, called the flagship cryptocurrency “rat poison squared,” while Dimon claimed it was a “fraud.”

Although Dimon later on claimed to regret his comment, Buffett and his lieutenant at Berkshire Hathaway, Charlie Munger, maintained their position comparing it to “turds” and “dementia.”

Per Armstrong, both are wrong about bitcoin, although their positions are understandable as most are initially going to be skeptical about new technologies. Now, however, he believes it’s getting harder to find cryptocurrency skeptics, although he estimated that about 10 percent of cryptos are used in real life.

He noted:

I think it will be quite some time before you cross the street to Starbucks in the U.S. and pay with crypto.

As CryptoGlobe covered, the Intercontinental Exchange’s Bakkt will have Starbucks as its “flagship retailer.” The coffeehouse chain won’t, however accept bitcoin at its stores, as it will be accepting cryptocurrencies converted into US dollars at Bakkt.

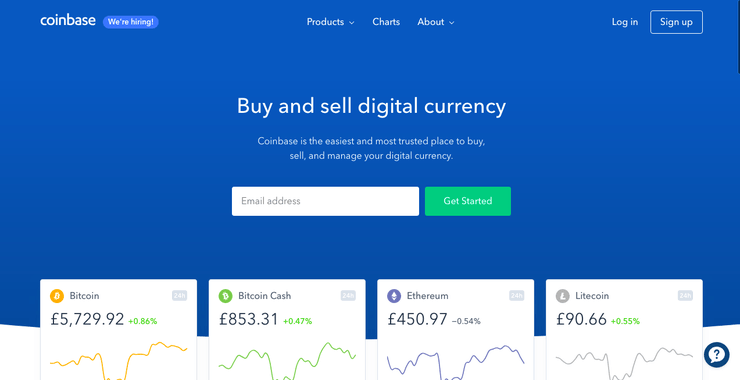

Recently Coinbase has been upping its offers to institutional and retail investors. It recently halved its Index fund’s fee from 2% to 1%, to make it more attractive, and added support for new features at its decentralized exchange.

As covered, falling cryptocurrency prices saw the San Francisco-based exchange’s popularity decline. Its app was the top finance app in the US back in December, and fell to 40th place in June, as the flagship cryptocurrency plummeted from a near $20,000 all-time high to about $6,440 at press time, according to CryptoCompare data.