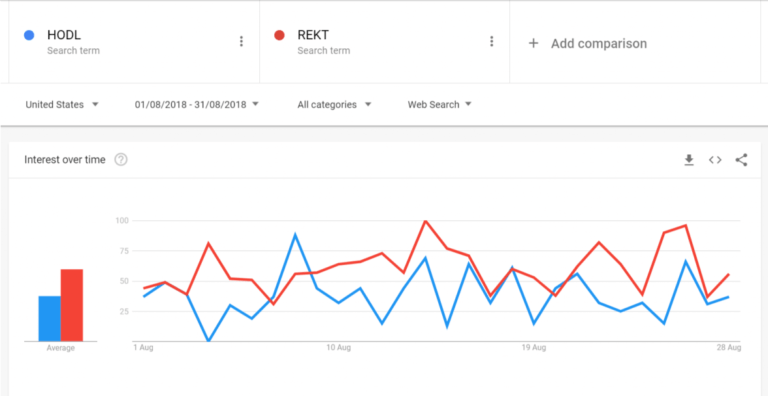

“HODL” vs. “REKT”

An enlightening indicator of market sentiment comes from comparing searches for the popular “HODL” phrase (a deliberate misspelling of ”hold” i.e. holding cryptocurrencies – originating in 2013) against “REKT” – a phrase used to connote losing big sums of money. This month it was interesting to see that “HODL” briefly reared its head above “REKT” which has prevailed for most of the bear market since January. Surging above “REKT” on August 8th, it is very probable that the SEC’s (US Securities and Exchange Commission) announcement on August 7th that it is delaying its decision on the much-anticipated VanEck-SolidX Bitcoin ETF until the 30th of September, led investors to dig their heels in and encourage a “HODL” sentiment.

Bitcoin ETFs

Continuing last month’s spike’s in interest for bitcoin ETFs, this month saw no let-up in the search interest for the term. With a particular surge in interest on August 22nd following the SEC’s decision to reject nine Bitcoin ETF proposals: two from ProShares, five from Direxion, and two from GraniteShares, before the SEC commissioner subsequently remarked that she will review the decisions.

Bitcoin vs. Beyoncé

Used as a kind of informal benchmark of bitcoin’s broader popularity, August saw bitcoin drop off in popularity against the popstar – contrasting with its previous months of dominance – with the graph reflecting the SEC-related spikes in interest on August 8th and 22nd.

Altcoins

Altcoins had a slightly more interesting month than July – with EOS and NEO maintaining their dominance (although some of NEO search may be attributed to the lead character of “The Matrix” trilogy for example). Two standouts include TRON’s spike in interest on August 11th following its acquisition of the sought-after blockchain.org domain name, and Ethereum’s surge on the 14th after the cryptocurrency (more precisely Ether) dropped to its lowest price in 2018 to fall below $300.