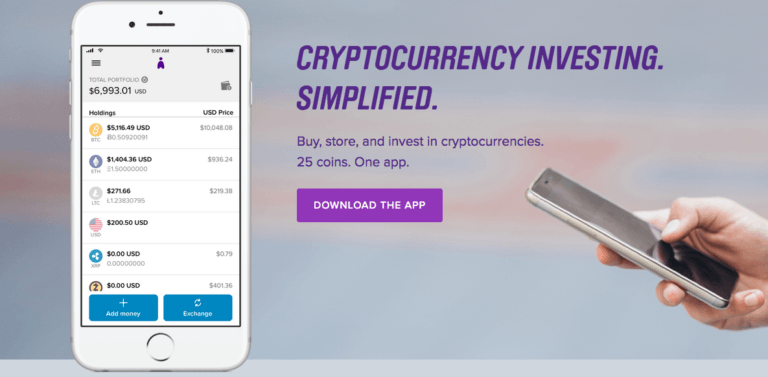

On Saturday (21 July 2018), Abra, the publisher of the mobile app (available for both Android and iOS) that combines a crypto wallet with a crypto exchange, released the “Ultimate Guide to Altcoins.” This article focuses on the highlights from this 30+ page report, in particular what makes each of these cryptocurrencies special.

Ethereum (ETH)

“A growing number of entrepreneurs and developers view Ethereum as a valuable tool and have started to use it to build decentralized businesses that couldn’t have existed before. Ethereum smart contracts can be used to eliminate third parties from many industries, which would lower costs and creates more secure products. Ethereum use cases are many, including decentralized identity registration, supply chain management, and democratized crowdfunding.

Due to the demand for ether, the value has increased rapidly over the past year. The Ethereum network now processes more transactions per day than Bitcoin. The number of applications and businesses have also been increasing at an exponential rate. Ethereum is only three years old, but it is showing tremendous potential to create trustless, decentralized applications that will be used by millions of people across the world.”

Litecoin (LTC)

“The main advantage of Litecoin is that it made day-to-day purchases possible. When the price of Bitcoin was low, purchasing something quickly and cheaply may have been possible, but at its all-time high in December 2017, buying a single cup of coffee with Bitcoin would have cost $30+ in fees. On top of that, the transaction would take at least an hour to process, if not much longer — not exactly ideal for everyday purchases. The cryptocurrency community is actively trying to solve this problem with technologies such as Lightning Network for Bitcoin, but as of today, these protocols have not yet been fully implemented.

Litecoin on the other hand, was designed to make payments instant, by enabling transaction verifications that take minutes rather than hours, which lowers transaction fees.”

XRP (XRP)

“Having raised over $93 million through traditional investment methods from some of the biggest names in venture capital, Ripple is much more than just a small team with a white paper or successful ICO (initial coin offering). The company itself is well-funded and counts the likes of UBS, Santander, Standard Chartered, UniCredit and American Express as customers.

Ripple primarily seeks to modernize cross-border payments on a global scale. Transferring money across borders using traditional methods, such as third-party services, is painfully slow, and almost always expensive. The fastest way to get money from San Francisco to Berlin is to literally hop on a plane with cash and y it there. A standard wire transfer or SWIFT payment can take days, and incur hefty fees. So, in an era of technological progress and rapid delivery of just about everything else on a global scale, why is it so difficult to move money from one country to another? Antiquated systems have created a need for new, less restrictive methods for transferring funds, and Ripple has developed a solution in an attempt to address this and modernize the global financial system.

Ripple and the XRP token run on the Ripple Protocol, which is built with private, centralized nodes. A node is a computer on the Ripple network that is authorized to verify transactions and keep the entire process running smoothly. In this fashion, the XRP ledger is not truly decentralized (like Bitcoin’s permissionless, distributed ledger which allows anyone with a computer and internet connection to download and run a node) but rather functions through the collaboration and agreement of 55 validator nodes, held by private institutions such as Microsoft and Massachusetts Institute of Technology. This gives the nodes authority over the network as opposed to a more decentralized system.”

Stellar (XLM)

“Stellar considers itself “finance with a mission.” Large portions of the world’s population remain unbanked, and Stellar seeks to make access and participation in the global economy universal. This philosophy is fundamentally inclusionary, and the entire codebase is open-source, meaning anyone can change or modify the code, and everyone can participate. Whereas Ripple is for-profit, Stellar plans to cover operational costs by setting aside 5 percent of the total available lumens for their own use, along with accepting donations. If Ripple is going after the banking industry, Stellar is going after the individual.

One of the strengths of Stellar is the team they have created to guide the network they are building. They offer grants of up to USD $2 million in lumens to developer partners on behalf of the Stellar Build Project. Stellar recently partnered with IBM as part of their Hyperledger project, where they will attempt to solve the problem of global cross-border payments together.

Furthermore, Stellar contains one critical component that is not found with Ripple — the ability to conduct ICOs on the Stellar network. In other words, new cryptocurrency projects can use the Stellar blockchain to release their own token. So far, most new projects in the cryptocurrency space have launched ICOs using Ethereum using ERC20 tokens. But, due to Ethereum’s popularity coupled with current scaling mechanisms, the past year saw massive backlogs of transactions with slow transaction speeds and volatile, hefty fees. Stellar promises faster transactions and lower costs than Ethereum, which is why some crypto startups have started to use Stellar as a platform to launch initial coin offerings.

These features, combined with the decentralized and altruistic mission of Stellar, have attracted favorable attention in contrast to the criticism facing Ripple. The two are pursuing very different things, and many feel there is room for both in the big picture of the global financial ecosystem.”

Dash (DASH)

“Dash is fungible. What this means is that one dash can be substituted for another dash, much like how one dollar can be traded for another dollar, regardless of where that dollar has been. As part of a transaction, once dash is mixed through a native-feature called PrivateSend, all previous history is cleared, making it impossible to distinguish one dash from another.

Since the digital cash is not held by a bank, purchase histories are private and they can never be tracked or intercepted. Transactions occur near instantaneously, with low or even zero fees because there’s no bank in the middle. What’s more, many businesses accept dash already — web hosts, VPN providers, web stores, marketing services, online games, and online casinos.”

Qtum (QTUM)

“Qtum features a strong team lead by Patrick Dai, who was recently acknowledged as one of China’s ’30 under 30′ to watch, with other team members coming from prestigious and well-known Chinese tech companies such as Alibaba, Baidu, and Tencent. Beyond their ICO capital, they are backed by more traditional capital from established angel and private investors in China.

A rarity in the blockchain world, Qtum is also backward compatible with Ethereum contracts as well as Bitcoin gateways and will remain backward compatible even after updates. This allows for easy platform adoption and a “plug and play” methodology that leans upon what other technologies in the space have done well.

Qtum is making a big push to create technology that is nimble and flexible enough to enable smart contracts on mobile devices and also plans to expand into IoT (internet of things) devices. Based in Singapore, Qtum is positioning itself to go address the Asian markets and even more specifically, the Chinese market.”

NEO (NEO)

“One of NEO’s biggest design features is accessibility because NEO projects can be coded in common programming languages such as C#, Python, and Java. This opens many doors to new developments within the ecosystem, with lower barriers to entry, and a more inclusive approach to collaboration on the project platform. This is important to any cryptocurrency platform allowing ICO’s, such as NEO, Ethereum, and Stellar, where other projects can release their own cryptocurrency on the underlying blockchain built by NEO.

With connections to both Chinese tech giant Alibaba, as well as potential good standing with a skeptical Chinese government, NEO is poised to address the Chinese market. It also features partnerships with Agrello, Bancor, and Coindash. The team behind NEO is also working with Fadada and Microsoft to collaborate on a project called Legal Chain, seeking to modernize and address the shortcomings of the legal system through digital applications.

NEO doesn’t allow forks and instead makes use of a special consensus mechanism known as dBFT (Delegated Byzantine Fault Tolerance). Transaction volume is another key component of NEO — up to 10,000 transactions per second are possible.

NEO also has some future-proofing baked into its core components. More specifically, the blockchain is being developed to be ‘quantum resistant,’ which will become increasingly important as quantum computers are developed that may be fast enough to crack the encryption.”

Zcash (ZEC)

“Zcash is important because Bitcoin lacks some privacy controls. Consider the following: With Bitcoin you have the sender’s address, the receiver’s address, and the amount transferred visible with every transaction. This is potentially problematic because let’s say you purchase an everyday item at a cafe — the restaurant will see your sender address, be able to look up your wallet on the public ledger, then be able to find the amounts of all payments you’ve sent and received. All this information is publicly available on the Bitcoin ledger, permanently recorded in the blockchain in a way that can never be altered. Great for verification that these digital funds have not been spent twice, but not so great for privacy.

Zcash addresses this problem by making all aspects of the transaction completely anonymous, private, and built upon strong encryption. This is possible using a system of zero-knowledge proofs called zkSNARKs.

Zcash has caught the attention of huge players such as JPMorgan, even establishing a partnership with the firm in their development of the enterprise-scale blockchain known as Quorum. JPMorgan may find such a system appealing in the case of wanting to secure their trades from the eyes of competitors, or in diligence required to protect data. As far as partnerships within the cryptocurrency world go, this one is a big deal.”

Featured Image Credit: Image Courtesy of Abra