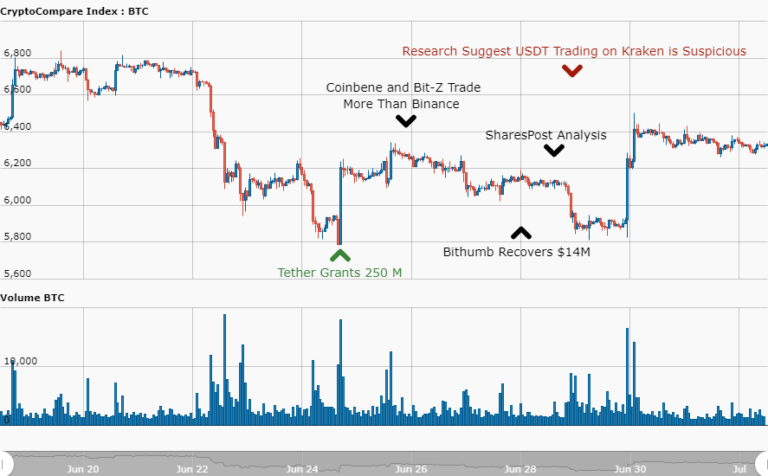

This week saw several interesting developments for exchanges while bitcoin dropped below the $6,000 mark, nearly reaching an eight-month low. New “trans-fee mining” exchanges hit the headlines for topping the trading volume rankings. Tether was also in the news a lot this week as it granted $250m and a report questioning the stablecoin’s trading on Kraken exchange stirred the crypto community.

New “Trans-Fee Mining” Exchanges Surge to Top of Trading Volume Rankings

Monday saw two exchanges surge to the top of the rankings for 24-hour trading volume after adopting the controversial new “trans-fee mining” model for exchanges.

Coinbene, a Singapore-based exchange, recorded over $2bn of trading volume in 24 hours, while Hong Kong-based Bit-Z posted a trading volume of over $1bn – both exceeding Binance’s 24hr trading volume of just over $800m.

Trans-fee mining sees exchanges moving beyond traditional fee-taking models – instead issuing their own tokens which are paid to users in return for their normal transaction fees in crypto.

With many – including Binance CEO Zhao Changpeng – criticising the new model for its potential for manipulation and the apparent similarity to ICOs, Sunday saw another exchange – CoinEX – soar to the top of the rankings after adopting a similar trading model.

Tether (USDT) Grants $250m

Monday also saw a major development for stablecoin Tether (USDT) as it granted $250 million.

This latest issuance put the total supply of Tether (USDT) at over $3 billion and will be particularly interesting for investors after a University of Texas study recently claimed that the token was used to manipulate the price of Bitcoin during last year’s bull market.

Some market commentators viewed the new issuance as bullish news – as it suggests large investors, known as whales, are entering the market.

Bithumb Exchange Recovers $14 Million in Hacked Cryptos, Details Compensation Plans

South Korean cryptocurrency exchange Bithumb, which was recently hacked for roughly $31.5 million worth of cryptocurrencies, claimed this week that it has managed to retrieve about $14 million of the lost funds, and has detailed a compensation plan for its users.

The exchange explained that funds were retrieved thanks to the “ongoing participation, support, and cooperation of the cryptocurrency exchanges and cryptocurrencies foundations across the world.”

It further detailed that the damages weren’t more severe thanks to Bithumb quickly moving most cryptocurrencies from its hot wallets to cold storage – adding that it’s going to compensate users through an “airdrop event,” details of which are still scarce.

SharesPost Research Suggests 15X Growth in Valuation of Cryptocurrencies and Blockchain Startups Over The Next 10 Years

SharesPost, a leading provider of late-stage private company liquidity solutions and private capital markets research, this week released a research report explaining why it believes the value of the companies in the blockchain space could exceed $2.5 trillion over the next ten years.

Titled “Investment Strategies for Blockchain: A $2.5 Trillion Opportunity?” the report highlights four ways in which investors can participate in the market: Investing in Cryptocurrencies; investing in Public Market Blockchain Proxies – via companies with blockchain projects such as IBM; investing in Tokens via ICOs and investing in Blockchain Private Growth Companies such as VC firms.

New Research Suggests Suspicious Tether (USDT) Trading on Kraken Exchange

A new analysis published by Bloomberg on Thursday has drawn attention cryptocurrency exchange Kraken’s trading data for Tether (USDT) – pointing out several apparently conspicuous features which it describes as “akin to defying gravity” in the world of exchanges:

Firstly, the report details how huge trades seemed to have moved prices almost exactly as much as small trades, and often even less – a feature experts view as a “red flag” for market manipulation.

Second, the data revealed a pattern of what seemed to be strangely specific order sizes – some of which extend to over 5 decimal places. Potentially used as a signal to automated trading programs, the report explains that these specific trades might be suggestive of “wash trading” – a tactic banned in regulated markets – where people trade with themselves to create a false impression of market demand.

With Kraken themselves since issuing a rebuttal of the Bloomberg report – which it claimed was “indefensible” – the story surrounding Tether seems to still be unfolding.

Bitcoin Nearly Hits Eight-Month Low, Surges back to $6,400

This week saw bitcoin’s price nearly drop to an eight-month low as it fell below $5,900 on Friday. The price quickly bounced back however as trading volumes spiked, reaching a near $6,500 high.

Enduring a bearish trend for the past few months, the flagship cryptocurrency has seen the $6,000 mark supporting its price every time a fall below the mark seemed imminent. A $5,900 price tag however, likely meant that support was failing to sustain the trend – with analysts at the time claiming the cryptocurrency could go as low as $3,000.

With bitcoin currently holding steady at $6,326 according to CryptoCompare, it seems that the dire predictions are for now off the table.