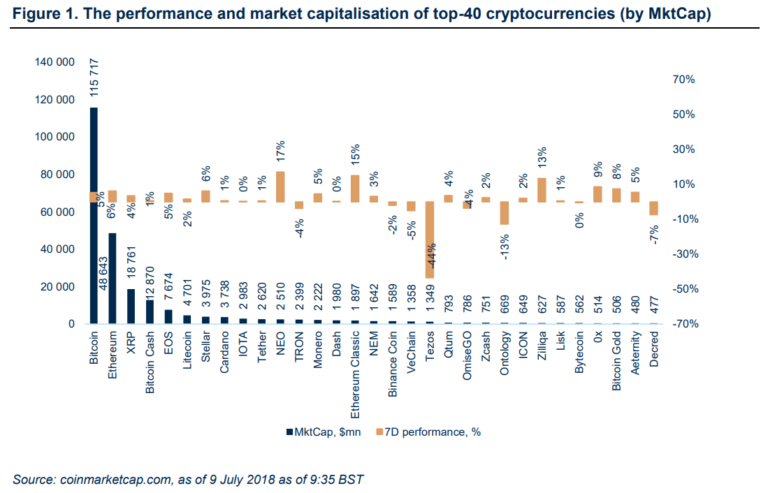

The cryptomarket recovered last week. With 4-6% gains from the top cryptocurrencies, top performers included NEO and ETC. Malta set a regulatory framework for Blockchain technology, Thailand SEC will introduce a new rule governing local ICOs, Ethereum suffers a gas crisis, South Korean banks investments totalled $1.79bn, Bitmain joined the list of EOS block producers and the largest ETF trader in Europe entered the cryptomarket.

Markets

The good recovery in the cryptocurrency market affected most of the crypto assets. Bitcoin recovered 5%, Ethereum 6% over the week since 2nd July. Best performers among the top-40 crypto assets were NEO (+17%) following the news about the launched decentralisation of the platform, Ethereum Classic (+15%) and Zilliqa (13%). Tezos started its trading and reportedly lost 44% in a week, and the network was valued at $1,349m.

Regulatory News

S. Korean banks’ investment in cryptoassets were $1.79bn in 2017 no concern for Bank of Korea

South Korean banks invested in crypto assets c. $2tn worth ($1.79bn) as of December 2017, according to the outstanding balance reported by the Central Bank. The amount represents c. 8% of the total deposits operated by South Korean brokerage houses, which reached $26 tn worth ($23bn). The Bank of Korea reported that the amount of crypto-asset investment is not big compared with the equity markets and local financial institutions’ exposure to the possible risks of digital assets is insignificant. The Bank of Korea expects that crypto-assets will have a limited impact on the South Korean financial market. The South Korea government have already introduced a series of measures, including a real-name account system, and a ban on investment by minors, to make the market more controllable and transparent. The government may come up with taxation on digital currency trading through a capital gains tax or sales tax. The government may also lift the ban on ICOs.

Malta sets regulatory framework for Blockchain technology

Malta is officially the first country which has passed a regulatory framework that makes the island even more open as regards the new technology. Three bills have been unanimously approved in a second reading. The bills include the Malta Digital Innovation Authority Act, the Innovative Technological Arrangement and Service Act, and the Virtual Financial Asset Act. The Parliamentary Secretary of Financial Services, Economy and Innovation, Silvio Schembri, shared a tweet, saying: “The three bills that will regulate DLT have been approved by Parliament and enacted into law”. Maltese Prime Minister, Joseph Muscat is perceiving the new legislation as proof that Malta is the first country worldwide with a “holistic legislative framework” and that Blockchain companies now have the formal tools necessary to operate in a regulated economy.

Thailand SEC will introduce a new rule governing local ICOs on 16th July

Thailand’s financial market regulator said that a new rule governing local ICOs will take effect on 16th July. Thailand may become one of the first countries to allow ICOs in a regulated framework. The SEC will first evaluate filings submitted by “ICO portals”, which are online marketplaces where potential ICO organizers can operate their token sales. Those approved ICO portals will be responsible for screening projects, after which the applications of selected projects will then be considered. ICO portal applicants must be registered businesses in Thailand with a minimum registered capital of THB 5m ($150k) and adequate resources to evaluate projects. SEC said that the Thai Baht and seven cryptocurrencies can be accepted in token sales, including bitcoin, bitcoin cash, ethereum, ethereum classic, litecoin, XRP, and lumens.

Market News

Binance expects 2018 profit up to $1bn

The CEO of Binance, Changpeng Zhao, said in an interview that Binance expects a net profit of $500m to $1bn in 2018. The company, which was opened for trading in July 2017 after raising $15m in ICO, received $300m revenue in 1H 2018. The average daily turnover is c. $1.5bn and Binance has 10m users. Binance had 2m users at the beginning of 2018. At peak market last year, the exchange had $11bn trades a day. Binance plans to allow customers in Uganda, Bermuda and Malta to convert their virtual tokens to fiat currencies, including the Euro.

V Buterin critisised centralised crypto exchanges

The co-founder of Ethereum, Vitalik Buterin, in his interview with TechCrunch, said that he hopes centralised exchanges “go burn in hell”. He criticized centralised exchanges for having the power to decide which cryptocurrencies “become big”, by charging “their crazy ten to fifteen million dollar listing fees”. Further decentralisation would better satisfy the blockchain values of “openess and transparency”.

Comments on gas crisis at Ethereum

There were several comments last week regarding the gas crisis at the Ethereum network. Ethereum users spent ETH 5,862 or $2.7mn to send transactions on 2nd July, which was an all-time high. Users should pay $3.2 for a transaction to be accepted, or wait for periods of 30 minutes for that transaction to be accepted into a block. The gas price essentially increases during the token creation periods. The gas price of GWEI 50 (ETH = GWEI 1bn) is the maximum gas price most new token creation period contracts will accept, compared to a GWEI 40 gas price during normal times. Most of miners follow a strategy, according to which they are sort the gas prices from highest to lowest, and include transactions to the block until the block is full. Thus, the lowest fee blocks may wait longer to be included into the block. Setting higher gas limits for the token sales, at 200,000 would be enough, according to block producers. That means the cost of transactions during the token creation period may vary from GWEI 40*200,000=ETH 0.008=$5.6 to GWEI 100*200,000=ETH 0.02=$14. There is a proposal from the Ethereum team to set the gas price mechanism using auctions, in order to improve transaction-fee markets and predictability of fees.

NEO starts decentralisation

NEO, the Chinese smart contract platform, announced its decentralisation plans. The NEO Foundation initiated the election of new consensus nodes, starting the era of decentralisation of NEO. “The candidate node run by City of Zion, after running smoothly on TestNet for over six months, got elected as the new consensus node”, according to the blog. The TestNet was launched in Nov 2015, and the MainNet was launched in October 2016, when 7 consensus nodes hosted by the NEO Council got voted. In January the network optimized the voting algorithm. In April 2018, the node hosted by KPN, one of the largest telecom companies in the Netherlands, started to run on TestNet, and the node hosted by Fenbushi Capital started to run on TestNet. NEO plans to open a public campaign for election of all consensus nodes in 2019.

Rapid Growth of Lightning network capacity

One of the major developing changes in the Bitcoin ecosystem, The lightning network, which can be perceived as a second layer payment protocol which will operate on the top of the blockchain (most likely 6 Bitcoin), will allow super fast transactions among the nodes and lower fees at the same time. At the beginning of the year only 89 channels existed, however the current status of the lightning network looks more promising with 8,856 channels and 2,710 nodes operating, making in total a monthly growth rate 60%+. If this exponential growth continues, the capacity will increase from 41 Bitcoins today to 120,000+ Bitcoins by the end to 2019, according to the calculations of Bitcoin economist and investor Tuur Demeester.

Bitmain to join the list of EOS Block Producers

The Beijing-based giant mining hardware company has received enough votes to become one of the 21 EOS block producers which will allow Bitmain to receive compensations for processing transactions on the EOS network. The Bitmain block producer is called EOS AntPool and will be run by AntPool, the largest Bitcoin miner. EOS AntPool is the 11th block producer with monthly earnings of EOS 840 tokens daily or EOS 308,425 annually. With the current rate of $8.8 per EOS, Bitmain will earn $2.7 million per year. Bitmain had a $2.5 billion in profit last yearof which $2.7 million represents only 1% of the total annual earnings.

Bitmain valued at $12bn

Bitmain was valued at $12bn in a new funding round Series B. The new equity financing is c. $300- 400mn. Leading investors in this round are Sequoia Capital China, US hedge fund Coatue and EDBI. Bitmain raised $50mn last year in a Series A funding round, led by Sequoia Capital China and IDG Capital. Bitmain may go public on the Hong Kong Stock Exchange in the future.

Major European ETF Group entering Crypto

The largest Dutch ETF trader Flow Traders, has entered the crypto market. The Amsterdam-based firm has expanded its trading products to exchange-traded notes (ETNs) based on Bitcoin and Ethereum, which makes Flow Traders the very first firm that is actively trading crypto ETNs on regulated stock exchanges. Dennis Dijkstra, co-CEO of Flow Traders stated on Bloomberg that “People underestimate crypto”, and “Institutional investors are interested – we know they are because we get requests”. Despite the negative stance of Dutch authorities towards crypto, as there is no legal restirction, neither Flow Traders nor any other Dutch firm can be restricted from trading regulated digital assets instruments.