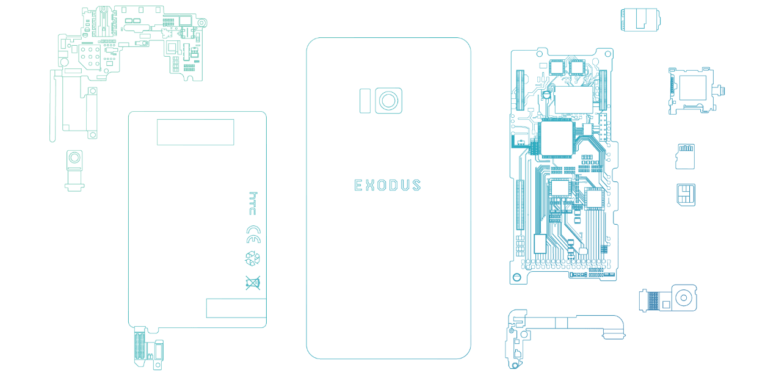

On 15 May 2018, at the Consensus 2018 blockchain summit in New York City, Phil Chen, the “Decentralized Chief Officer” for the Taiwanese smartphone manufacturer HTC announced the firm’s plan to create HTC Exodus, “the world’s first native blockchain phone.” This article summarizes everything that we know so far about this device:

- The operating system for the phone is Android (with some HTC customizations, of course).

- The plan is for Exodus to support “underlying protocols such as Bitcoin, Lightning Networks, Ethereum, Dfinity, and more.” As covered by CryptoGlobe yesterday, according to Litecoin founder Charlie Lee, who met the Exodus team last week, the phone will also natively support Litecoin; furthermore, Lee will be acting as an advisor to the project.

- Although “early access” is promised in Q3 2018, we expect general availability in the U.S. or Europe to arrive in Q4, towards the end of the year (since HTC needs to make sure that the phone is available during the most active shopping period of the year). In fact, in an interview with The Verge on 10 July 2018, Chen said that we should expect the phone around the end of this year. As for price, although he wanted to give a specific number, when told that competitor SIRIN Labs will be selling its “Finney” blockchain phone for under $1000, Chen said that the price of the Exodus, which would be announced by the end of Q3, would be “comparable.” As for availability, he said that Exodus would have global availability once released, and that it would be available “definitely everywhere outside of China” (since “China has different rules, everywhere from regulations to how Android even works in China”).

- Every phone will be a node (HTC says it wants “to double and triple the number of nodes of Ethereum and Bitcoin”).

- It will have a cold hardware wallet.

- It will have a built-in Decentralized Apps (DApps) store.

- According to Chen, while the phone will not initially offer on-device crypto mining, HTC is studying this problem to find a more efficient mobile mining approach, and it is hoping to release a white paper with details about this later in the year.

- Chen is the person who floated the idea of a blockchain phone to HTC executives, and by early 2018, HTC’s developers had started working on software for the phone.

- There is a partnership with blockchain-based virtual cat breeding/trading game CryptoKitties (to encourage gamers and “the non-crypto crowd” to try the Exodus). On 12 July 2018, HTC (via a tweet) invited developers to distribute their “blockchain game, collectible and NFT concept” on the Exodus. On 13 July 2018, HTC sent out another tweet to tell us that the partnership with CryptoKitties is “just the beginning of a non fungible, collectible marketplace and crypto gaming app store.”

- Dominic Williams, who works at DFINITY has said via a tweet that we should expect “hardware within the phones to facilitate secure private key management, transparent gas payments when using Dapps and more.”

- The upcoming pre-sale for the phone will only accept bitcoin and ether as payment options.

Featured Image Credit: Image Courtesy of HTC