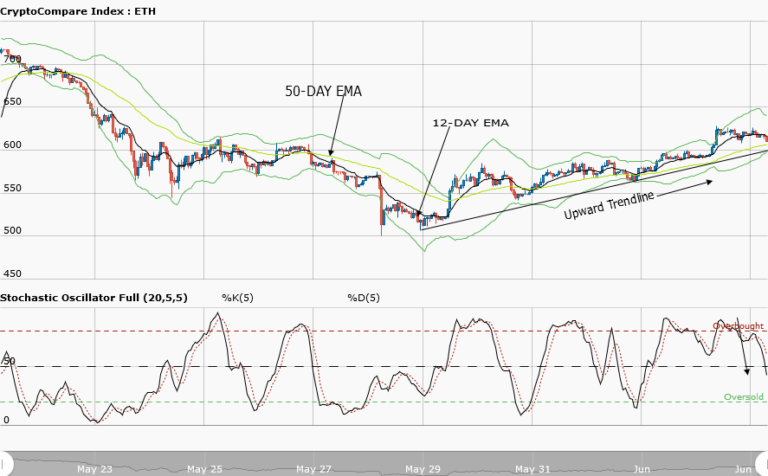

Ethereum Price Medium-term Trend: Ranging

Supply zones: $600, $650, $700

Demand zones: $300, $250, $200

ETH continues ranging in the medium-term outlook. The bulls had a brief return as they pushed price to $485.28 in the supply area within the upper range of yesterday analysis. The formation of a doji and a bearish spinning top returned the bears to the market.

Price is currently below the 12-day EMAs with the Stochastic oscillator in the overbought region at 78 percent. Its signal is pointing down. These imply strong bearish pressure and price may head south in the medium-term.

ETH remains in consolidation and is trading between $481.55 in the supply area of the upper price range and at $444.45 in the demand area of the lower price range. Patience will pay off in this instance as a breakout from the upper price range or a breakdown at the lower price range will occur soon.

Ethereum Price Short-term Trend: Bullish

ETH is in bullish trend in the short-term outlook. The bulls took price up to $485.28 in the supply area after the break of the supply zone above the EMAs crossover. The formation of a bearish spinning top a reversal candlestick pattern set the stage for the bears returned.

The bears returned with a large bearish candle that closed below the 12-day EMA. The bearish pressure is strong as we see price moving down to retest the demand area at $468.61.

The bears’ pressure should be seen as a pullback necessary for market correction. Price may get to 50.0 or 61.8 fib level that is trend reversal zone before the bulls stage a comeback for upward trend continuation in the short-term.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.