Ethereum Medium-term Trend: Ranging

Supply zones: $700, $750, $800

Demand zones: $350, $300, $250

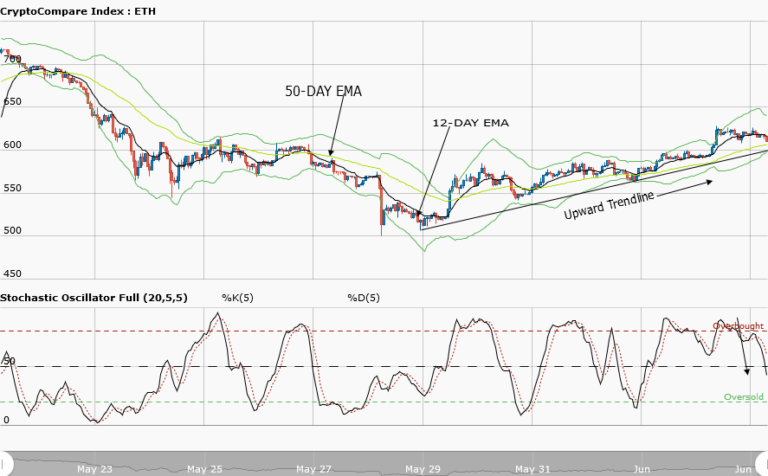

Ethereum is ranging in the medium-term outlook. The bulls failure for further upward price push above the $506.65 in the supply area after retesting the broken support now demand zone at $491.74 returned the bears back to the market. This is below the 12-day EMA which is a reflection of the bears’ pressure.

The bulls are gradually pushing price back up but momentum is low, price was barely at $480.00 in the supply area. The Fibonacci retracement has price in the 50.0 fib level. This is a trend reversal zone. The stochastic oscillator is in the oversold region at 23 percent and its signal is undefined.

The cryptocurrency is ranging and trading between $490.83 in the supply area of the upper price range and $466.20 in the demand area of the lower price range. Patience should be exercised as the aftermath of the consolidation will produce a breakout to the upside or a breakdown at the downside.

Ethereum short-term Trend: Ranging

ETH is ranging in the short-term outlook. The bears’ pressure was strong and broke the trendline of yesterday analysis retested it before dropping the cryptocurrency at $469.17 in the demand area. Momentum was lost at this area and the bulls gradually returned and pushed price back up. Currently at $480.18 in the supply area.

The cryptocurrency is consolidating and trading between $487.32 in the supply area of the upper price range and $471.34 in the demand area of the lower price range. Caution should be exercised to allow for a breakout at the upper range for a long position or a breakdown at the lower range or a should position.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.