If a system is only as strong as its weakest link, then the centralized exchanges are certainly the Achilles heel of the cryptocurrency ecosystem and ultimately are hampering the growth of the decentralized financial industry. Although Bitcoin, Ethereum and other ‘blue-chip’ cryptocurrencies have shown resilience against malicious actors and government intervention, the exchanges on which they are traded provide a single point of failure, contributing to the uncertainty surrounding the space. Centralized exchanges have been hacked and raided by governments, as Upbit found out when it was targeted by Korean prosecutors , proving the need for a decentralized solution which will infuse trading with the protections of trustlessness and permissionless.

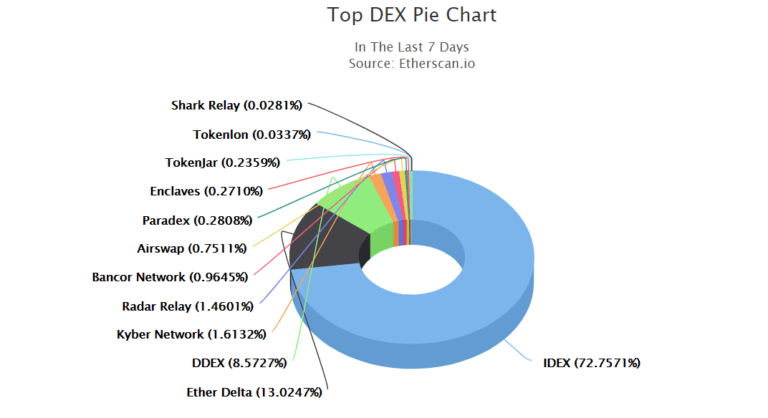

The first popular exchange to grant users control of their private keys, allowing them to trade in a decentralized fashion, was EtherDelta. However, security concerns and usability surrounding the project have seen it lose its status as industry leader to IDEX, beta launched by Aurora DAO in September 2017. IDEX commands a sizable majority of dExchange trading volume, with 81% of daily dEx trading volume taking place on their platform.

0X Used on the Majority of DEX’s

Out of the following 10 exchanges by trading volume, 7 of them are built on top of the 0x project. Built on Ethereum, 0x provides an open source system of smart contracts for the development of decentralized exchange applications. Aside from traditional exchanges, the 0x protocol facilitates the creation of more sophisticated financial applications such as decentralized derivative and prediction markets. Decentralization and speed are achieved by transferring the orders off-chain, using the Ethereum blockchain for settlement only.

The 0x protocol, built on Ethereum, introduced a solution in the form of off-chain order books. While the execution of trades occurs on the Ethereum blockchain, giving users control of their funds until the exchange takes place, the order books are hosted by third-parties called Relayers. These Relayers host and maintain order books and, using the 0x architecture, can pool their liquidity together creating a more robust trading infrastructure. After submitting an order to the Relayer, a market maker waits for a taker to fill that order, at which point the exchange is trustlessly executed on the blockchain.

Industry heavyweights are paying attention to decentralized exchanges, as evidenced by the Coinbase’s acquisition of Paradex, a decentralized platform inspired by 0x. While Coinbase customers are currently serviced by their GDAX exchange which does $169million in daily volume, Coinbase remains committed to “investing in decentralized infrastructure and participating in the nascent world of wallet-to-wallet trading.” Indeed, as this technology matures, we can expect to see a larger share of trading volume shifting towards the decentralized exchanges.