Bitcoin (BTC) has had a turbulent day.

Dropping over 5% in price this morning to fall below the $8,000 level – it seems that the slump was prompted by the SEC’s (US Securities and Exchange Commission) rejection of the Winklevoss twins’ bitcoin ETF application for the second time.

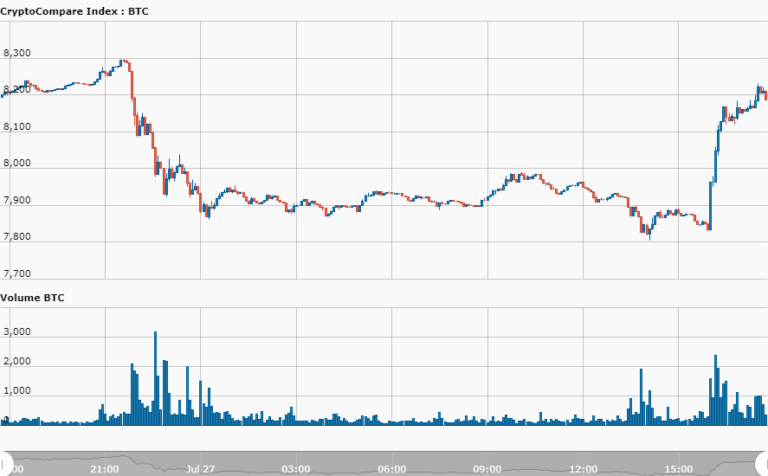

The cryptocurrency however, has almost completely bounced back to its former heights at the time of writing – regaining over 4% to approach the $8,200 mark – as the title chart from CryptoCompare shows.

All About ETFs

With many suspecting that the current mini-bull run is largely motivated by anticipation surrounding the SEC’s proposals from VanEck and SolidX – it is likely that investors took the rejection of the Winklevoss’ ETF has a bad sign ahead of the SEC’s decision – expected in mid-August.

While there are numerous other bitcoin-related ETF proposals currently lodged with the SEC, those of VanEck and SolidX have generated by far the most attention – with several hundred comments submitted regarding the proposals on the SEC website.

For comparison, the proposals filed by Boston-based ETF provider Direxion Investments at the time of writing have prompted only three comments.

With bitcoin in the latter half of July bucking the generally bearish trend, investors will be encouraged by the resilience shown in the face of ostensibly bad news. A truer test of market sentiment however, will likely emerge when the SEC’s decision on the more hotly-anticipated bitcoin ETFs arrives.