Data from CryptoCompare and Crypto51

When Satoshi conceived of Bitcoin as peer-to-peer digital cash, he introduced the Proof-of-Work mining system as a means of incentivizing network participants to play fair. PoW secures the network by having miners run computationally intensive puzzles, known as the ‘work’, before they are able to append new transactions onto the blockchain.

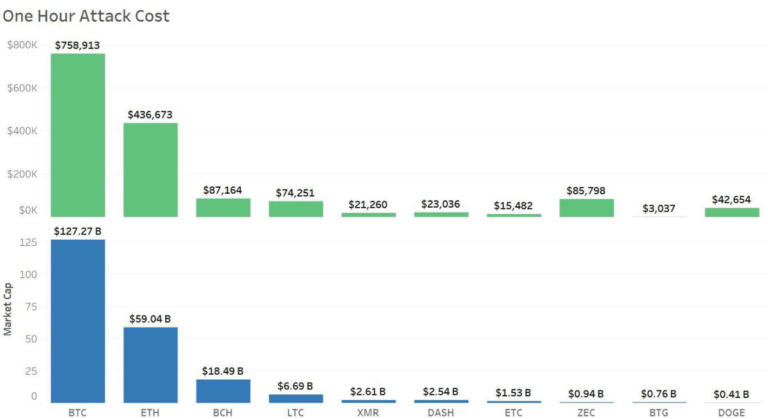

In order for a bad actor to attack the network, they would have to control 51% of the computational capacity, the hash power, of the network. Crypto51 puts the total hash power currently securing the Bitcoin network at over 42,000 PH per second while the cost of leasing out 1 PH of hash power for a single hour, from hash power rental service Nicehash, is $17.89.

At over $700,000 an hour, the enormous costs associated with procuring the necessary hash power to launch a successful attack, coupled with the fact that a potentially malicious actor could simply utilize their hash power in an honest manner to mine bitcoin, means that the Bitcoin blockchain is impervious to these type of attacks. Indeed, in its 9 years of existence, the Bitcoin blockchain has yet to be breached by this type of attack.

Under Attack

Not all Proof-of-Work blockchains are created equal.

Smaller coins which require less computational work to secure their blockchains have been coming under increasing attacks recently. Bitcoin Gold, a fork of the original Bitcoin blockchain, requires one trillionth the amount of hash power compared to Bitcoin, with the costs of a 51% attack – a measly $3,000 an hour. Hackers took advantage of this security vulnerability by making off with $18million after attacking Bitcoin Gold.

BTG is not alone, as ZenCash and Verge have both been breached in the last week. Litecoin Cash, a fork of Litecoin which reverted to using the same hashing algorithm as Bitcoin, recently came under a 51% attack, proving that small-cap PoW coins are under a particular threat of attack. Clearly, Proof-of-Work leaves much to be desired as a consensus mechanism for smaller cryptocurrencies.