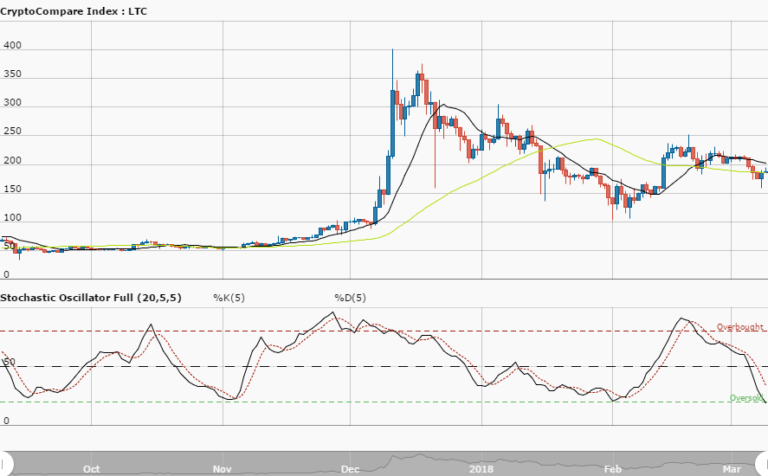

LTCUSD Long-term Trend: Bearish

Distribution territories: $150.00, $170.00, $190.00.

Accumulation territories: $100.00, $80.00, $60.00.

LTCUSD, at the start of the week, experienced slow ranging movements in the market trend. On May 21, a short Japanese bearish candlestick was formed below the intersectional point of both SMAs. As a result, buyers were slightly overpowered by the sellers. The sellers eventually managed to drive the market value southward, close to the accumulation territory of $110.00, on May 28.

On the following day, the pair notably entered a ranging movement as both sellers and the buyers seem to have lost a hold of the market. The 50-day SMA is above the 13-day SMA and both have been below the $150 distribution territory.

The price action is now averaging along the 13-day SMA trend-line. The Stochastic Oscillators are trying to determine their next direction below range 50. The current ranging movements on LTCUSD are expected to be short-lived, and die out within next few days or weeks.

Sellers may soon be able to drive the market trend towards the accumulation territories of $110.00 and $100.00, which may denote a good return for buyers who play the market. Traders can be on the lookout for a decent long entry.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research