EOSUSD Medium-term Trend: Bearish

Supply zones: $16.00, $17.00, $18.00

Demand zones: $11.00, $10.00, $0.9000

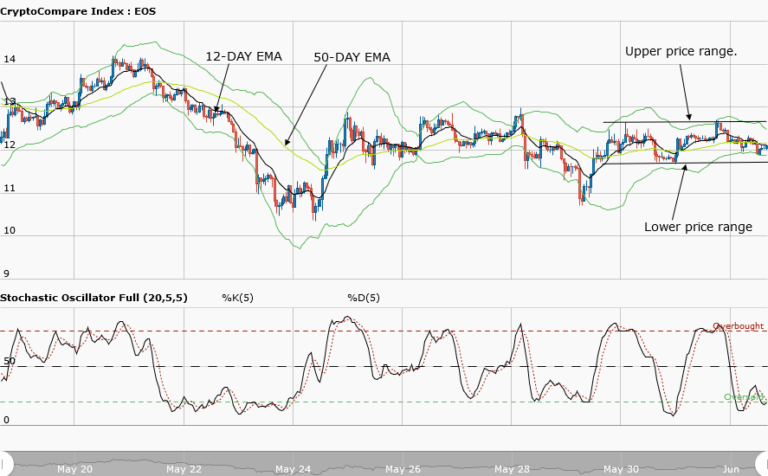

The bearish trend continues in the medium-term outlook of Eos. The increase in bear momentum the pushed price further south – breaking the demand zone at $13.00 and making a further low at $12.84. A bullish railway track was formed at this area, and this brought the the bulls baclk to the scene. Their attempt to push the price high was rejected. The 10-day EMA serves as a strong resistance against the upward move – as you can see from the chart. The dail candle opened below the 10-day EMA which indicates more sellers in the market for a further push of the price to the downside. Today’s opening price was $13.63 as against yesterday’s opening of $14.44 which is a reflection of the bears’ pressure. The Stochastic oscillator was in the oversold region – but was rejected for upward momentum. Conversely, the downward momentum will prevail in the medium term as the bears keep the pressure high.

EOSUSD Short-term Trend: Bearish

The medium-term outlook of the pair remains bearish. The bears kept the market under control as downward momentum was kept strong. From the supply area at $14.00 the price was pushed down to the demand area at $12.80. The bulls activities were minor in this area and may likely be a correction for a further price downward slide. The upper range of the Bollinger band serves as a good resistance while the lower range serves as a good support. The stochastic oscillator is at 41 percent and its signal points down which implies downward momentum in price. The bears may likely retest the $12.50 demand area in the short term.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.