The Coinbase Index Fund, which was first announced on 6 March 2018, is now open for investment. This article gives you an executive summary of everything you need to know.

The purpose of the fund is to give U.S. accredited investors (certain individuals or legal entities) exposure to all the digital assets that are listed on Coinbase Pro, weighted by market capitalization. As new digital assets, such as Ethereum Classic (ETC), are added in the future, the fund will be rebalanced to include them.

So, why is Coinbase limiting access to this fund to only U.S. accredited investors?

Well, according to the U.S. Securities and Exchange Commission (SEC), under federal securities laws, “a company that offers or sells its securities must register the securities with the SEC or find an exemption from the registration requirements.” And since the SEC currently does not seem interested in granting regulatory approval to any cryptocurrency index funds or exchange traded funds (ETFs), the only way for Coinbase to sell what would be classed as an unregistered security is to find an exemption from the registration requirements. Under one of these exemptions, Rule 506 of Regulation D, a company may sell unregistered securities to “accredited investors.”

Rule 501 of Regulation D defines accredited investors as follows. An individual is an accredited investor if he/she has a net worth of $1 million (excluding primary residence), or consistent annual income of at least $200,000 (or combined income of $300,000 with your spouse), and a legal entity is considered to be an accredited investor if all of the equity owners are accredited investors.

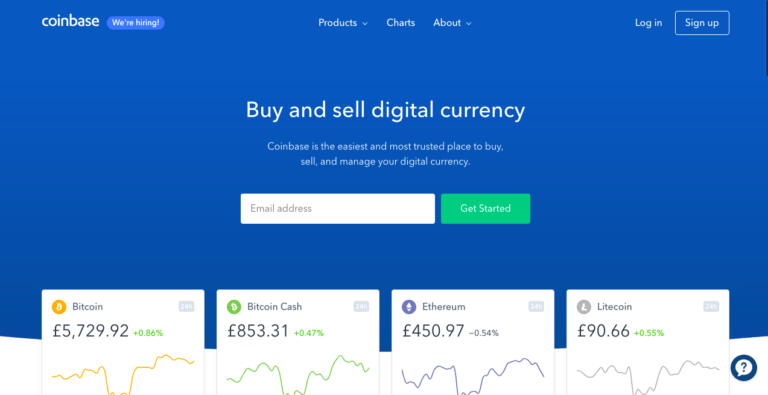

The Coinbase Index Fund aims to track “Coinbase Index (Fixed Supply)”, which is a version of the Coinbase Index that eliminates the effect of ongoing supply increases (as new tokens/coins are awarded to miners) to make the index capable of being tracked by investors (since investors cannot get any benefit from the value of the new tokens/coins). It can be seen as a measure of the overall performance of the digital assets that are listed on Coinbase Pro (although, confusingly, some of the relevant sections of the Coinbase website still refer to its old name, GDAX).

According to Coinbase, whenever “an investor invests in the fund, the fund deploys the investor’s capital by buying assets in proportion to their weighting in the index” and whenever “an investor wants to leave the fund, the fund can sell assets in proportion to their market weighting in the index at that time, and return the proceeds to the investor.”

As of 1 May 2018, the composition of the Coinbase Index Fund is Bitcoin (58.47%), Ethereum (27.39%), Litecoin (3.41%), and Bitcoin Cash (10.73%).

The Coinbase Index Fund is operated by legal entities (two Coinbase affiliates — Coinbase Asset management, Inc and Coinbase Fund Manager, LLC) that are separate from Coinbase, Inc (which operates Coinbase and Coinbase Pro). Also, various policies/procedures have been adopted to help ensure that the fund is treated no differently from any other client of Coinbase Pro.

The minimum investment is $250,000, and there is a fixed 2% management fee, which Brian Armstrong, the Coinbase CEO, considers “much cheaper than 2 and 20% charged by most crypto hedge funds.”

Realizing that there is a huge demand from retail investors who do not qualify as accredited investors, Coinbase, on its official blog, says that it is “working on launching more funds which are accessible to all investors and cover a broader range of digital assets.”