Circle, the FinTech startup backed by Goldman Sachs, Bitmain, and Baidu, has decided to explain how it evaluates cryptoassets that it is considering adding to its crypto investment/trading platforms Circle Invest, Circle Trade, and Poloniex.

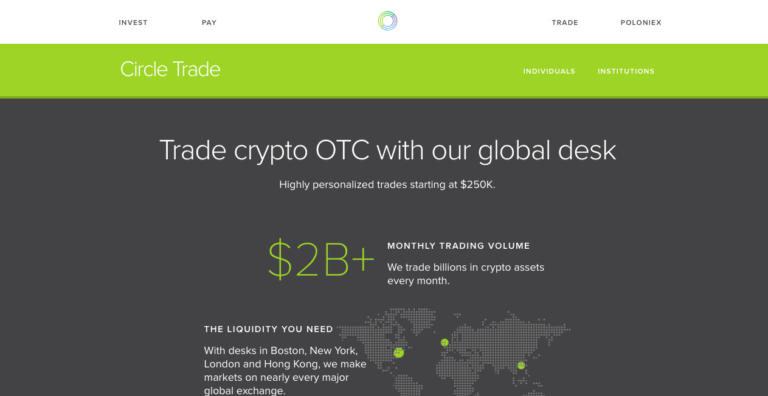

In a blog post published on Tuesday, 19 June 2018, Circle says that it uses a cryptoasset evaluation framework (called “Asset Framework”) when deciding what assets it should make available to its customers by listing them in its various products, such as crypto trading app Circle Invest, OTC crypto trading desk Circle Trade, and crypto exchange Poloniex (acquired on 26 February 2018).

Circle’s Asset Framework evaluates each asset across five categories: “fundamentals, technology, people, business model, and market dynamics.”

Here are a few examples of questions in each of these five categories:

Fundamentals

- “Does the project add fundamentally new infrastructure to the industry?”

- “Does the project digitize a new type of non-traditional asset?”

- “Does the problem solved by this project benefit from decentralization and/or peer-to-peer networks?”

Technology

- “Is the project well-documented, peer-reviewed, and open source?”

- “To what extent is the project being actively developed?”

- “How distributed is ownership of the token?”

People

- “Does the leadership team have experience building cryptocurrency projects?

- “What is the size of the development team?”

- “Do members have experience with blockchains and other relevant fields?

Business Model

- “What specific pain point or problem does the project aim to address in the long-term?”

- “Is there utility in holding the token or in using it to participate in the network?”

- “Is there unique benefit to using this token versus competing projects?”

Market Dynamics

- “How many exchanges is the project listed on? How well-represented is the project across exchanges?”

- “How well-distributed were contribution amounts resulting from an ICO?”

- “Is there interest in the project from the crypto community at large?”

Circle says that it tries to answer these questions using publicly available data or information submitted by projects via its Asset Listing Form.

According to a Bloomberg report published on 6 June 2018, Circle is planning to get a federal banking license (so that it can offer a retail banking service), as well as broker-dealer and alternative trading system licenses from the U.S. Securities and Exchange Commission (SEC) for its Poloniex exchange.