BitBay, the largest cryptocurrency exchange in Poland, has decided to move to Malta as it isn’t able to open a bank account in its country. Per the company, Malta was chosen for its friendly take on cryptocurrencies, and a new supplier will run BitBay under its jurisdiction.

According to available data, BitBay had a $9 million trading volume in the last 24-hour period. It allows users to trade 29 cryptocurrencies against the Polish zloty, with 87 percent of said volume being on the BTC/PLN pair.

Per the exchange, the last bank willing to work with it unilaterally ended their working relationship, which forced BitBay to move. The company’s announcement reads:

“Unfortunately the last Polish bank ready to provide bank services undertook unilateral decision to finish the cooperation with BitBay with the effect at the end of May. In those circumstances the continuation of providing high quality services by BitBay exchange in Poland is no longer possible.”

As a result, the exchange’s users will no longer be able to trade Polish zlotys after May 31, and by September 17 its trading platform won’t be operational in Poland. By then, customers will only be able to withdraw their funds from BitBay’s platform.

The exchange has already encouraged users to create an account with it when it starts operating in Malta, and clarified the company will still exist in Poland as it will “carry out other challenges than conducting cryptocurrency exchange.”

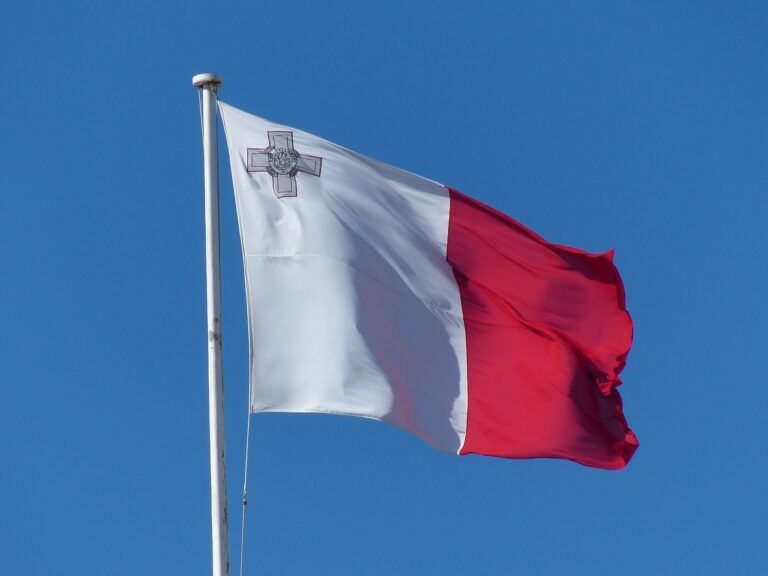

Malta is becoming a cryptocurrency haven, whose prime minister called cryptos the “inevitable future of money.” The region, which sees most cryptocurrency trading volume flow through it, was selected after careful analysis.

“BitBay has been conducting analyses for many months within the scope of the most friendly jurisdiction for cryptocurrency in the European Union. Productive discussions with the government of Republic of Malta and friendly business environment provide BitBay assurance that the choice of Maltese jurisdiction is the best solution.”

Poland’s attitude towards cryptocurrencies has been somewhat controversial. Earlier this year, Polish news outlet money.pl discovered the country’s central bank paid a popular YouTuber to smear cryptocurrencies in a video.

Specifically, the central bank paid Marcin Dubiel $30,000 to create a video called “I LOST ALL THE MONEY?!,” in which the protagonist was embarrassed at a restaurant with his date, and lost money invested in cryptocurrencies. It was never disclosed the video was a paid promotion.

Poland’s attitude towards blockchain technology, however, seems to be different. As covered by CryptoGlobe, it became the first country to put banking records on a blockchain.